Quick links

Chairs Introduction

I am honoured to be the new Chair of the Council of the University of Essex, taking over from Jane Hamilton who saw the University through the pandemic and the financial pressures facing the sector as a whole with extraordinary calmness, wisdom and dedication. Jane had been a valued and influential member of the University’s Council since 2015 and Chair since 2019. We also said goodbye to our Vice-Chancellor, Professor Anthony Forster who retired at the end of the 2023-24 academic year, having led the University through a period of extraordinary growth and achievement since August 2012. In particular, Professor Forster is remembered for his leadership on complex and controversial issues, communication and engagement with stakeholders, most notably students and the Students’ Union. Professor Maria Fasli has taken over as Acting Vice-Chancellor for this academic year, building on her success as Executive Dean of the Faculty of Science and Health.

In the face of significant financial challenges for UK universities, we have put in place a range of measures that allowed us to safeguard the student experience, protect jobs and the current range of subjects and disciplines. We will continue to take steps to manage challenges and capitalise on opportunities in the years to come.

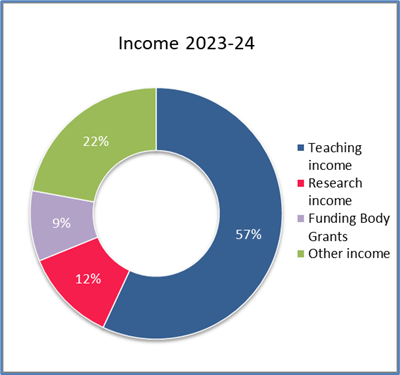

While we had record numbers of applications for postgraduate taught programmes that commenced in October 2023 and January 2024, increases to visa costs, NHS surcharges for international visitors, withdrawal of visas for dependents of all but research students and extended visa processing times saw actual student registrations fall significantly short of target. Overall, tuition fee income was £30m below budget for the year and the University responded quickly to reduce expenditure. Reflecting poorer prospects for tuition fee income, the University Council approved a reduction in our cash surplus target from 5.5% to 1% (£3.2m) for Academic Year (AY) 2023-24 and a minimum of 2% for each subsequent year in this strategic planning period (up to and including AY 2028-29). We adjusted our capital investment plans accordingly, keeping our education and research infrastructure up to date but excluding new buildings.

As we enter the 2024-25 academic year, we are delighted to welcome more new undergraduates onto our campuses than in the previous year. Nonetheless, we are very much aware that it will take several years of growth in intakes for our total undergraduate population to return to levels we enjoyed in academic year 2020-21. With improving league table rankings (rising to 23rd in the Guardian University Guide, 30th in the Complete University Guide and rising 10 places to 46th in the Times Good University Guide) we left no stone unturned to ensure that we recruited our fair share of the growing numbers of potential students in London and the eastern counties and from across the United Kingdom for 2024-25. Like most other universities in the United Kingdom, our intake of international undergraduate and postgraduate students was limited by the new visa regime.

We are adapting rapidly to the new challenges that we face: updating our curriculum and identifying new activities, including continued professional development and apprenticeships (of which we now have 378 courses) and new forms of UK and international partnerships. Operating through our due diligence and quality control procedures, income from academic partnerships was £7.9m, up from £4.5m in AY 2022-23. This growth included strong recruitment to the new arrangements with Aegean College in Greece, the Portobello Institute in Dublin and Laksamana College of Business in Brunei.

Financial Sustainability

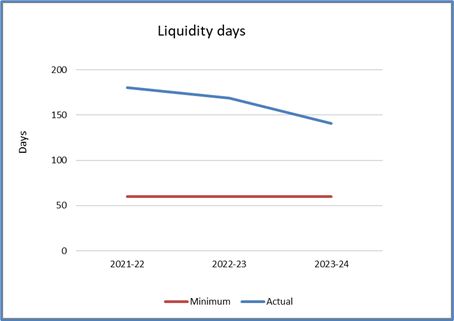

The University Council has set a requirement for a minimum of 60 days liquidity, exceeding the 30-day minimum set by our regulator, the Office for Students. We have exceeded our 60-day target achieving 141 days, supported by £83m in cash and deposits and £40m available from a revolving credit facility.

This left us able to conduct essential refurbishments and updates of our estate and infrastructure and improve energy efficiency. Our total long-term borrowing continued to reduce, steadily, to £138.4 million from £140.7m at the start of the academic year.

The University declared a climate and ecological emergency in December 2020 and has set a date of 2035 to reach net zero scope 1 and 2 carbon emissions. Our Sustainability Sub-Strategy sets the aims, objectives and actions to reduce our carbon emissions and further our sustainability work. Our scope 1 and 2 carbon emissions have reduced by almost 28.2% from 11,897 tCO2e in 2019-2020 to 8,540 tCO2e in 2023-24, demonstrating the significant progress being made.

University League Tables

We were ranked 23rd in the Guardian University Guide, 30th in the Complete University Guide, and rose 10 places to 46th in the Times Good University Guide.In the Times Higher World Rankings we are ranked in the top 100 for Social Sciences and Law; top 200 for Economics and Business Studies and Psychology; and top 250 for Computer Science. We have also been ranked firmly within the top 100 institutions for the third year running in this year’s Times Higher Education Impact Rankings.

Education and the Student Experience

We were pleased to see good performance in the National Student Survey 2024 and Essex is first in the East of England for the 'overall positivity' measure. Within the various elements of the survey, we ranked in the top 10 for learning resources and in the top 20 for academic support. Essex is ranked 30th among 100 English broad-discipline higher education institutions for overall positivity, based on student feedback analysed by Times Higher Education. It was particularly pleasing to be above benchmark for all seven key areas of the survey.

Students’ Union

Our Students’ Union has been awarded the King’s Award for Voluntary Service. Within the context of volunteering being at a historic low in England, for over 20 years our students have been making change happen through volunteering. This remarkable commitment has now earned our V-Team this most prestigious award, the highest possible accolade for volunteering in the UK. Ours is the first Students’ Union to win the award in many years and it is worthy recognition for our incredible student volunteers who have this year contributed an amazing 40,000 hours of their time to projects that make a positive difference to the lives of others. The Union is ranked 16th nationally for its effectiveness in representing students and has recently been ranked within the top 10 Students’ Unions in the country in the WhatUni Student Choice Awards 2024. This is the sixth year in a row that our Students’ Union has been ranked in the top 10.

Research and Knowledge Exchange

In 2023-24, income from research grants and contracts exceeded previous records at £37.7m and are forecast to reach £40m in 2024-25. This is a 10% increase on our previous all-time high of £34.3m in 2022-23, which in turn represented a 14% increase on our previous year’s performance of £30.2m. In addition to this, we were awarded £138m for national social sciences infrastructure in our Institute of Social and Economic Research and the UK Data Archive. Not only is this the largest single investment in a university from UK Research and Innovation, but it also further consolidates the University of Essex as a global leader in authoritative social science.

I am delighted that we have performed particularly well in this year’s Higher Education Business and Community Interaction survey. The survey collects financial and output data related to a range of activities including business and public or third sector involvement in research, consultancy and the commercialisation of intellectual property; and other activities intended to have direct societal benefits. We reported over £37m, an increase of £8.6m on last year and were delighted with our ranking of 14th in the sector in the Knowledge Exchange Framework. We ranked first, again, out of all universities in the UK for the number of Knowledge Transfer Partnerships we have been awarded.

Other Successes

- Once again, Times Higher Education (THE) has named the University of Essex in the top 100 of its global Impact Rankings – which evaluates 2,152 universities across 125 countries. Essex is 58th overall in the THE Impact Rankings – the third year in a row Essex has earned a place in the top 100.

- Wivenhoe Park has been awarded the Green Flag Award for an eighth successive year in recognition of its status among the country’s best outdoor spaces.

- In the British Council Alumni awards, 12 Essex graduates from 9 different countries were shortlisted. Of these individuals, two were Global finalists, three were National finalists, and one was crowned a National winner.

- We are in the top 30 in the UK in the British Universities & College Sport (BUCS) overall league table - our highest ever finish and our highest number of BUCS points – a remarkable achievement for a University of our size.

- We also won a Basketball England ‘Best Gameday Experience Award’.

Capital Developments

This year saw the completion of Clingoe House, a new 40,000 square foot building at the entrance to our Colchester Campus. Clingoe House is the home of our Institute of Public Health and Wellbeing, and new health and wellbeing hubs open to the public, and follows the success of Parkside Office Village, it also provides lettable commercial space with new tenants due to move in shortly, strengthening our links with business and the community.

Through our Pastures development on our Colchester Campus, 1,262 new study bedrooms were occupied from September 2024. We completed a project to re-clad our student residences at University Square Southend, and we are vigorously pursuing legal redress for the cost of this work from third parties.

Given that we have reduced our future annual cash surplus targets (which are annual contributions to capital budgets) from 5.5% to 2% of total income, we have also rationalised our capital investment programme. We have revised our current capital investment plans to include £89m of investment to keep our infrastructure for education and research up to date and progress our Sustainability Sub-Strategy.

Treasury and Investments

We are conscious that the value of our cash balances is being eroded by inflation. I’m very grateful for the work of our Investment Committee and staff in securing over £5.6m in investment income in 2023-24, in comparison with £3.6m in the previous academic year.

People

As we are celebrating the University’s diamond jubilee year, we welcomed our new Chancellor, renowned author Dr Sarah Perry, and said goodbye to our Vice-Chancellor, Professor Anthony Forster who retired at the end of the 2023-24 academic year, having led the University through a period of extraordinary growth and achievement since August 2012. In particular, Professor Forster is remembered for his leadership on complex and controversial issues, communication and engagement with stakeholders, most notably students and the Students’ Union. Professor Maria Fasli has taken over as Acting Vice-Chancellor for this academic year, building on her platform of leadership in her role as Executive Dean of the Faculty of Science and Health.

I wish to offer my sincere thanks to three outstanding members of Council who concluded their service on the University Council at the end of AY 2023-24. The University has benefitted enormously from the experience, wisdom and expertise of Tim Porter, who joined Council in 2015 and soon became Treasurer, ably chairing the Audit and Risk Management Committee for nine years. As President of the Students’ Union (SU), Kieran Phillips contributed significantly to the work of Council, for AY 2023-24 and we are very grateful for his leadership in ensuring the SU is ranked in the top ten in the country again. Professor Diana Presciutti provided valuable insights at Council whilst also ably leading the newly formed School of Philosophical, Historical and Interdisciplinary Studies. I would like to welcome new members to Council: Faten Ghosen, Robert Hale, Lesley Smith and Lily-May Cameron, as President of the Students’ Union.

We are also grateful to Professor Lorna Fox-O’Mahony who served as a member of the University Steering Group (USG) for eleven years, initially as the Executive Dean for the Faculty of Arts and Humanities and then as Deputy Vice-Chancellor. Lorna was the driving force behind the University strategy and planning round and is now focussing on a period of research leave. Professor Neil Kellard has taken over as Acting Deputy Vice-Chancellor for AY 2024-25.

At the end of the AY 2023-24, Professor Madeline Eacott retired as Pro-Vice-Chancellor Education having led many initiatives contributing to the University’s impressive performance in the National Student Survey. Madeline handed over to Professor Larra Anderson.

Earlier in the year, Professor Nancy Kula concluded her successful term as Executive Dean of the Faculty of Social Sciences to take up a new position at the University of Leiden. Nancy is succeeded by Professor John Preston.

In conclusion

These are very difficult times for UK higher education. Nonetheless, I am confident the University of Essex can continue to thrive by embracing innovation in education with its partners, diversifying income through expansion of research and knowledge exchange, and providing high quality services for students, staff and the community. It is heartening to see our campuses buzzing again as numbers of undergraduates recover towards pre-pandemic levels and we remain true to our international ideal of finding the world in one place at Essex. I would like to thank all staff and students for their hard work in challenging times for higher education in the UK.

Melanie Leech

Chair of Council

3 February 2025

Highlights from 2023-24

- 1st in the UK for Knowledge Transfer Partnerships.

- "Very High Quality" Education (Silver Rating Overall, (Teaching Excellence Framework 2023)

- Research Power - 5 subjects in the UK Top 10. (Research Excellence Framework 2021, Times Higher Education)

- TOP 5 in the UK for ‘value added’ (The Guardian University Guide 2025)

- Research Quality - 4 social science subjects in the UK Top 10 (Research Excellence Framework 2021)

- 30th in England for ‘overall positivity’* (Times Higher Education 2024)

- 58th in the world in the Times Higher Education Impact Rankings

- Top 20 for international outlook. (Times Higher Education World Rankings 2024)

- 130,000+ alumni around the world

- 23rd in the UK in the Guardian University Guide 2025

We remain a key member of the Young Universities for the Future of Europe (YUFE) and the Young European Research Universities Network (YERUN).

*Essex is ranked 30th in England for 'overall positivity' across all questions in National Student Survey 2024.

Figure includes all English broad-discipline higher education institutions. (Times Higher Education 2024)

Strategic Report

Objectives and strategy

Our mission is to deliver excellence in education and research, for the benefit of individuals and communities. We are proud to offer a transformational research-led education, welcoming students to the University based on their potential, helping them to fulfil that potential, and transforming the lives of everyone who chooses to study at Essex.

As we navigate the post pandemic landscape, the higher education sector is evolving in response to significant challenges and opportunities. Government policy changes in respect of global mobility have negatively impacted international student recruitment, which is a key area of income generation for universities; any potential shift in policy under a new Labour government could bring change, however we remain vigilant as the government settles on its priorities.

On a positive note, the sector has seen a record number of UK 18-year-olds apply for the 2024-25 intake year, reflecting strong domestic demand.

Financial performance during 2023-24

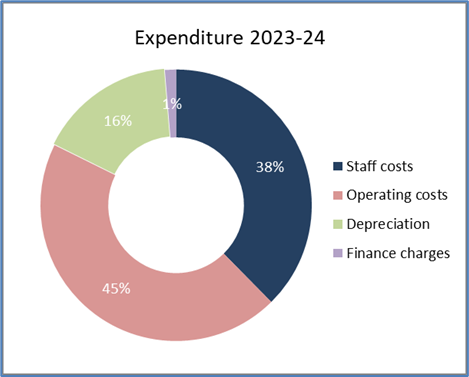

Financial sustainability remains a challenge across the sector however the financial performance of the University remains positive, delivering an accounting surplus of £52.3m and a cash surplus, measured as the surplus for the year plus non-cash transactions (depreciation and movements in investment property valuations, fixed asset investments and provisions) less capital grants and loan principal repayments, of £5.4m (1.7%).

Campus Services includes Accommodation and Sport within the University, and two subsidiaries; University of Essex Campus Services (UECS) Ltd and Wivenhoe House Hotel (WHH) Ltd. Campus Services made a surplus of £0.3m 2023-24 before an accelerated depreciation adjustment, mainly for the North Towers, compared to a £3.4m surplus in 2022-23. The reason for a lower surplus is fewer students living in University accommodation. The accelerated depreciation adjustment of £6.7m reduces the overall Campus Services position in 2023-24 to a £6.4m deficit.

To counter the impact of rising inflation on the University’s cost base, the University was able to secure £5.6m through cash investment and interest returns; this is an increase of £2.1m on 2022-23 and is a result of careful cash management and the diligent placement of funds in a range of short and long-term fixed interest instruments.

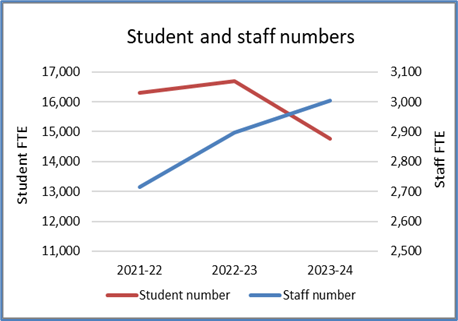

The total student population is close to 14,500 FTE, representing a decrease of around -11% versus 2022-23. From a headcount perspective, the total student population is close to 18,000, again representing a decrease of around -11% versus 2022-23.

Our research grant and contract income reached a new record high of £37.7m, growing by 10% versus 2022-23. The indirect costs recovered from this activity also saw very strong growth of 18.4% rising to £8.3m, our highest level in the strategic planning period (2019-25).

| |

2022-23

£000

|

2023-24

£000

|

Year-on-year movement |

| Research contract income |

34,331 |

37,744 |

+9.9% |

| Research

contract indirect

costs recovered |

7,021 |

8,314 |

+18.4% |

Increasing academic staff numbers remains a key priority. Over the 12-month period from August 2023 to July 2024, average academic staff numbers increased by 57 FTE to 1,043 FTE (5.8%) and total average staff numbers by 108 FTE to 3,005 FTE (4%) from 2022-23.

Capital investment

The Capital Investment Plan (CIP) supports the delivery of the University’s Strategy and its commitment to excellence in education and research.

A revised CIP was agreed by Council in July 2024. Included within the CIP are projects to support the growth and sustainability of the University, underpinned by a commitment to repurpose existing space where possible.

Following the development of the University’s Sustainability Sub-Strategy, consideration is being given to how the University can make a just and equitable transition to net zero carbon emissions and to reducing its impact on the environment. The revised Capital Investment Plan incorporates significant investment for sustainability-led projects, to deliver our Sustainability Sub-Strategy, and with respect to our climate and ecological imperatives.

The categories of project identified for potential investment within the capital plan are as follows:

- Reduction of risk/regulatory compliance

- Financial sustainability

- Transformation and achievement

- Efficiencies, performance, and innovation

- Environmental sustainability

| |

2021-22

£000

|

2022-23

£000

|

2023-24

£’000 |

| Total investment |

£14,113 |

£23,016 |

£27,383 |

Major Projects in 2023-24 included:

- Smart Working at Essex (SWAE) Phase 2 - This £1.3m project is now complete and continued the roll out across the University of the digital infrastructure.

- Parkside Phase 3a – The Parkside Phase 3a building reached completion in November 2023. Works to complete the fit out of the Health and Wellbeing Hubs on the ground floor of Clingoe House, Parkside have now been completed at a cost of £2.7m. The space has been designed to provide a range of multipurpose clinical rooms, designed to NHS health standards. The launch of the hub took place on the 21 March 2024, and was an opportunity to showcase our services, with attendees able to see live sessions and demonstrations. The services offered for launch range from falls prevention, memory clinic, health promotion, health checks, and interdisciplinary support for children, young people and adults with multiple and complex health and wellbeing needs.

- Refurbishment of the existing estate to provide new Teaching Spaces – This project provided additional permanent teaching spaces to accommodate larger cohorts of students as well as smaller study spaces at a cost of £2.5m.

- Sustainability – £2.9m has been spent on sustainability related projects in 2023-24. Works undertaken have included re-roofing the Constable building and part of the 1960s estate at Colchester, LED lighting upgrades to spaces across Colchester and Southend campuses, improved sub-metering across all three campuses and continuing work on decarbonisation.

- Research – Expenditure on research equipment in 2023-24 totalled £3.6m. Some of this expenditure was externally funded. £2.8m was incurred in a Smart Technology and Experimental Plant Suite (STEPS) which will provide state of the art growth facilities for our fundamental and applied plant-based research.

Debt, liabilities and liquidity

Despite the need to secure higher returns to counter the impact of inflation, cash continues to be managed prudently and good returns secured through investing for longer maturities where possible. Cash, cash equivalents and short-term investments decreased to £75.8m (2022-23: £101.8m) over the year. The University Council set a requirement for a minimum of 60 days liquidity, and we achieved 141 days of general expenditure (excluding depreciation) at 31 July 2024, compared with 169 days in 2022-23. Total long-term debt outstanding at 31 July 2024 was £138.4 (2022-23 £140.6m). The University was fully compliant with its banking covenants for all drawn debt.

2023-24 Performance Updates

Many positive performance outcomes have been achieved across 2023-24.

Guardian University Guide 2025

- Essex moved up 7 places to rank 23rd in the Guardian University Guide 2025, our highest ever rank in this table. This represented a 62 place rank improvement over the last four publications. Essex continues to rank 4th nationally in the Guardian’s Value-Added metric – a metric that indicates the extent to which a student exceeded expectations, based on entry qualifications.

Complete University Guide 2025

- Essex moved up two places to 30th in the Complete University Guide 2025 – ranking 3rd nationally for facilities spend and 4th for academic services. We are also 30th for research intensity.

Times Good University Guide (TGUG) 2025

- Essex moved up ten places, to 46th, our highest rank since TGUG 2022 (published in 2021) and our first rank rise since TGUG 2018. In addition, Essex rose 4 places, to 29th in the Times’ Social inclusion table, which is our highest ever ranking in this table.

National Student Survey (NSS) 2024

- Our performance in the National Student Survey showed continued improvement this year, with the University ranking 30th for Overall Positivity amongst English Broad Discipline institutions (100 institutions), and 1st in the East of England. Further, rank performance improved in five the seven sections of the NSS, with three of these sections considered performing above our benchmark. Seven questions sits above the benchmark performance, with none sitting below benchmark (all other questions in line with benchmark).

- The latest Teaching Excellence Framework (TEF) dataset (that which will eventually populate the TEF 2027 dataset), finds two of the seven sections to be materially above benchmark (with the remaining five all in-line with benchmark).

- For the first time TGUG utilised the new version of the NSS using an aggregate of NSS 2023 and 2024. This resulted in a rank rise of +41 places on the Student Satisfaction metric, to 39th. This includes rises of +42 places in the Teaching Quality half of the metric and +28 for the Student Experience half of the metric (which now ranks 25th).

Graduate Outcomes 2024

- This year’s Graduate Outcomes survey (surveying 2020-21 graduates) found 87% of our biggest population – undergraduate, UK, full time students – were in some level of employment or further study 15 months after graduation, and 89% of our postgraduate students.

- The latest TEF dataset (that which will eventually populate the TEF 2027 dataset) finds our Graduate Outcomes to be marginally above our benchmark (+0.6, regarded materially in line).

Knowledge Exchange Framework (KEF4)

- The fourth iteration of the KEF saw Essex rank 11th in the sector overall (previously 14th), and 2nd in Cluster X (previously 3rd), and achieved our target of being in the top 50% for all perspectives.

- Essex has achieved ‘high’ or ‘very high’ engagement in all seven KEF perspectives and met or exceeded the Cluster X average in all seven.

- Essex ranked 4th in the sector for the “working with the public and third sector” perspective.

Times Higher Education – World University Rankings 2025

- Essex was ranked in the 351st–400th bracket in the world and 39th of UK institutions. Within this table, Essex is 17th in the world for ‘International Outlook’. At the subject level, four subjects rank in the top 200 – Law (49th), Social Sciences (74th), Business & Economics (152nd) and Psychology (194th).

TEF 2023 and direction of travel for 2027

- In 2023 we were awarded overall TEF Silver, as well as Silver awards in both of the new elements: student experience and student outcomes. Silver indicates that “the student experience and outcomes are typically very high quality, and there may be some outstanding features”.

- As this TEF cycle assessed the period 2018-22, we now have 2023 and 2024 performance data that will underpin the next TEF submission in 2027. This early insight shows the latest data, that which will constitute the first two years of the next cycle, sits materially above benchmark on two sections ‘Learning Resources’ and ‘Organisation and Management’, with a further six sections above benchmark. No overall metrics are regarded materially below benchmark. Therefore, our improved performance sets us up well for the next TEF cycle.

THE Impact Rankings 2024

- Essex remains in the top 60 in the THE World Impact Rankings this year, ranking 58th out of 1,963 institutions across the world in the prestigious Times Higher Education (THE) Impact Rankings, which recognise universities for making a difference to society and working towards a more sustainable future.

- This measures universities against the Sustainable Development Goals and this year Essex was ranked in the top 100 globally for five of these 17 goals. The highlights were being ranked 22nd for Reduced Inequalities, 28th for Responsible Consumption and Production, 31st for Gender Equality, 40th for Decent Work and Economic Growth, and 54th for Climate Action.

Our strong performance in the Impact Rankings demonstrates how our efforts to operate in more sustainable and socially responsible ways are helping us to evolve as a University fit for the future. The result also reflects the world-leading contributions that our academic community continues to make through education and research in topics that have the greatest relevance and importance to the future of science, society, and humanity.

We have committed to reaching net zero carbon emissions by 2035 and we take our promise very seriously. We are continually acting and making new investments to ensure that not only are we improving the carbon footprint of our campuses but we are developing innovative education and research practices that are sustainable without compromising on excellence.

In our fourth Sustainable Development Report, which we have recently published, we are delighted to provide a more detailed update of our performance in relation to each of the UN Sustainable Development Goals (SDGs). The report also incorporates the full results of our 2024 Times Higher Education Impact Rankings and examples of our activities that have made a positive contribution to each SDG.

Measuring the contribution of the University in progressing each of the Sustainable Development Goals is not easy, instead, we have adopted keyword methodologies commonly used across the higher education sector, including the Times Higher Education Impact Rankings.

There are two commonly used keyword sets for each of the Sustainable Development Goals. The first set was developed by the Asia/Pacific Sustainable Development Solutions Network (SDSN), which is very broad, and the other is the Elsevier keyword set, which is used by the Times Higher Education and is much narrower. For our research we have used both keyword sets to search our publications using the Scopus indexing service, reporting the number of publications and citations Essex has achieved for each goal from 2012 to 2023. For our education we have indicated how many programmes relate to each SDG and how many student interactions there have been across these programmes since 2012.

Table 1: Research Publications and Citations Assosciated with each Sustainable Development Goal

|

Publications

|

Citations

|

SGSN |

Elsevier |

SGSN |

Elsevier |

SDG 1: No Poverty |

3805 |

61 |

73237 |

671 |

SDG 2: Zero Hunger |

2754 |

96 |

70017 |

3182 |

SDG 3: Good Health and Well-being |

2362 |

1880 |

51201 |

42439 |

SDG 4: Quality Education |

1645 |

35 |

28093 |

456 |

SDG 5: Gender Equality |

1999 |

143 |

31283 |

1179 |

SDG 6: Clean Water and Sanitation |

1065 |

26 |

24136 |

328 |

SDG 7: Affordable and Clean Energy |

1614 |

319 |

37544 |

7686 |

SDG 8: Decent Work and Economic Growth |

4291 |

275 |

69525 |

6720 |

SDG 9: Industry, Innovation and Infrastructure |

5346 |

71 |

100380 |

3956 |

SDG 10: Reduced Inequality |

5291 |

305 |

89290 |

4869 |

SDG 11: Sustainable Cities and Communities |

3204 |

136 |

70171 |

2424 |

SDG 12: Responsible Consumption and Production |

2958 |

147 |

66035 |

3638 |

SDG 13: Climate Action |

1049 |

283 |

27762 |

7599 |

SDG 14: Life Below Waster |

570 |

181 |

17057 |

3673 |

SDG 15: Life on Land |

1561 |

90 |

41292 |

3859 |

SDG 16: Peace and Justice Strong Institutions |

41292 |

3859 |

46709 |

8975 |

SDG 17: Partnerships to achieve the SDGs |

246 |

N/A |

5262 |

N/A |

Table 2: Degrees Associated with each Sustainable Development Goal and Student Engagments

|

Relevant Degrees

|

Student Engagements

|

SGSN |

Elsevier |

SGSN |

Elsevier |

SDG 1: No Poverty |

893 |

88 |

14404 |

877 |

SDG 2: Zero Hunger |

707 |

30 |

11163 |

88 |

SDG 3: Good Health and Well-being |

547 |

346 |

6925 |

4199 |

SDG 4: Quality Education |

671 |

21 |

7713 |

130 |

SDG 5: Gender Equality |

606 |

173 |

7367 |

803 |

SDG 6: Clean Water and Sanitation |

252 |

3 |

1643 |

28 |

SDG 7: Affordable and Clean Energy |

219 |

1 |

1692 |

64 |

SDG 8: Decent Work and Economic Growth |

1016 |

175 |

17806 |

1325 |

SDG 9: Industry, Innovation and Infrastructure |

1257 |

35 |

16881 |

242 |

SDG 10: Reduced Inequality |

1082 |

174 |

18359 |

1030 |

SDG 11: Sustainable Cities and Communities |

656 |

20 |

7836 |

180 |

SDG 12: Responsible Consumption and Production |

596 |

83 |

7824 |

1209 |

SDG 13: Climate Action |

247 |

121 |

2201 |

1419 |

SDG 14: Life Below Waster |

214 |

62 |

2385 |

290 |

SDG 15: Life on Land |

295 |

28 |

2287 |

165 |

SDG 16: Peace and Justice Strong Institutions |

627 |

344 |

9184 |

3414 |

SDG 17: Partnerships to achieve the SDG |

170 |

N/A |

1154 |

N/A |

Future outlook and prospects

The number of 18-year-olds in the UK is due to rise by 4% for the 2025 intake with the most rapid growth in the areas from which the University recruits most of its home students. We are already seeing higher numbers of applications for 2025 entry than we saw at the same point in the cycle for 2024 entry. Therefore, we have confidence that the recovery in numbers of undergraduates from the UK will continue. Prospects for recruitment of international students are harder to evaluate. Tightening of the visa regime for students coming to study in the UK has had a significant impact; however with Canada and Australia also introducing caps on international student numbers, the UK could see a surge in demand from those seeking alternative study destinations. In the face of ongoing uncertainty and volatility, the University seeks to further expand the number of students studying for its qualifications through high-quality overseas partnerships, supporting both financial stability and research excellence. It aims to grow income from transnational education from £7M in 2024 to £22M by 2030, generating an additional £9M surplus to support the University’s financial stability and research excellence.

Many of the early career researchers recruited over the last five years are progressing to win larger research grants and contracts, with successive breaking of record levels of research income forecast to continue up to the 2029 Research Excellence Framework.

Risk

Policy and approach

The University maintains a Risk Management Policy, which forms part of the University’s internal control and corporate governance arrangements. The policy explains the University’s underlying approach to risk management and documents the roles and responsibilities of the University Council, the University Steering Group (USG) and other key parties. It also outlines key aspects of the risk management process and identifies the main reporting procedures. In addition, it describes the process the University Council follows to evaluate the effectiveness of the institution’s internal control procedures.

The following principles underlie the University’s approach to risk management and internal control:

- Council has responsibility for overseeing risk management within the institution as a whole.

- The Vice-Chancellor and University Steering Group (the University’s Executive) advise the Council and implements the policies it approves.

- The Audit and Risk Management Committee (ARMC) provides Council with independent assurance about the effectiveness of the University’s risk management arrangements.

- External Audit has an overview of the policy, making comments and recommendations of practical benefit.

- Internal Audit provides ARMC and Council with independent assurance about the effectiveness of the University’s risk management arrangements.

- The institution makes prudent recognition and disclosure of the financial and non-financial implications of risks.

- Heads of Departments and Heads of Section are responsible for developing awareness of risks within their units, and for identifying risks inherent in new developments.

- Key risk indicators are identified and monitored regularly.

Risk appetite

The University recognises that risk appetite varies according to the activity undertaken and has developed a matrix determining its willingness to accept risks in pursuit of its strategic objectives. The approach is to minimise exposure to risks in the areas that relate to Health and Safety, regulatory compliance and the University’s duty of care to staff and students, whilst accepting and encouraging the active management of risk in order to pursue strategic priorities as defined in the University Strategy 2019-28. The matrix maps the University’s risk appetite against key strategic aims and compares the potential impact if things were to go wrong against the benefits if opportunities are realised; progress in realising those benefits is measured using a set of Key Performance Indicators, providing a measurable value that demonstrates how effectively the University is achieving key business objectives.

Risk ownership and management

The Registrar and Secretary, as the Risk Management Process Owner, is responsible to the Vice-Chancellor and USG for ensuring the operational effectiveness of the University’s risk management procedures. The Risk Management Group (RMG), chaired by the Chief Financial Officer, provides guidelines on the assessment of risk in planning and decision-making and monitors compliance. The Chief Financial Officer ensures that the Strategic Risk Register (SRR) is properly maintained, that the relevant preventive and recovery measures are implemented, and that a sufficiently comprehensive set of risk management plans are maintained.

For control of operational level areas, Faculties, Departments and Professional Services sections maintain local operational risk registers that identify risks and relevant mitigating actions. Local risk management groups conduct operational risk register reviews at least once a year and material changes (the addition of new risks, the removal of risks and significant changes to risk ratings) are reported to RMG on a cyclical basis. This provides a clear route for risk identification and escalation. Risk owners are also required to report on the potential impact of risks on the Strategic Risk Register as well as any associated resource, legal, regulatory or equality implications, which require consideration by the University. Operational risk register updates enable RMG to understand local issues and to check consistency in scoring across broad risk themes; these, along with the strategic insight of RMG members and their knowledge of changes in the internal and external environment, allow RMG to assess the Strategic Risk Register critically on a termly basis.

Major movements in the risk environment and the University’s risk profile are then drawn to the attention of USG and ARMC by way of termly reports. This allows members of the executive team and external committee members to bring to bear their different perspectives, knowledge and experiences when scrutinising and contributing to the development of the Strategic Risk Register, ensuring that key areas of risk are not overlooked.

USG provides information to Council and to ARMC on a regular basis and will report on major risks and associated ameliorative measures. Council, which is responsible for reviewing the effectiveness of the internal control and risk management framework of the institution, will, on the basis of the information provided in the annual report from the Audit and Risk Management Committee, form a view on the effectiveness of the risk management framework. It provides guidance to USG on ways in which procedures may need to be improved. The Risk Management Policy is reviewed annually by the Risk Management Group, ensuring that the policy is updated periodically to ensure that it remains fit-for-purpose and in line with best practice.

Key risks

The University’s vision for 2028 is to be recognised nationally (ranked in the top 30 in the Times Good University Guide) and globally (ranked in the top 200 Times Higher Education World University Rankings) for the quality and impact of our transformational education and for the international excellence and world-leading quality, scale and impact of our research. The risk of the University not meeting its targets for overall performance and national and international ranking and academic standing has been evaluated as the highest rated strategic risk.

Essex saw vast improvements in Student Satisfaction (+41 places), one of only two new datasets used, in the latest publication of the Times Good University Guide (TGUG 2025), resulting in a rank improvement of 10 places, to 46th. This is our highest ranking in four publications and is our first rank rise in seven iterations, since the 2018 guide. Much of the fall in rank since that point can be attributed to successive methodology changes that have accompanied each release, including the removal of the Services/Facilities Spend metric (which Essex would have ranked 1st for in the previous two iterations), and the continued use of historic datasets including NSS 2022 (instead of NSS 2023) and pre-pandemic entry tariff scores.

We aspire to offer a transformational education to about 20,000 students, foster ground breaking research through a community of about 1,000 researchers, extend our knowledge base by investing in new disciplines that meet the needs of our time, and to ensure the financial sustainability of the University. All student recruitment markets remain volatile, with home recruitment still recovering from the impact of the pandemic, and international recruitment substantially impacted by changes in visa policy and political narrative; this has presented a risk to us achieving these aims, but we have been agile in our response through new product development, the introduction of a range of incentives to maximise applications and conversions, and enhanced investment in marketing, particularly for the clearing period.

A number of coincidental changes in senior leadership and governance roles presented us with a potential risk of a leadership vacuum. To mitigate this risk, we took several actions, including; the appointment of experienced internal members of staff with significant leadership experience to acting executive leadership roles; an effective and experienced executive group and Council with extensive experience of the University; well established mechanisms for ensuring regular and proactive interaction between the University’s executive and Council to ensure open dialogue and effective oversight; a clear and well-established strategic plan and strategic planning process to ensure the University community as a whole is clear on the University’s mission, priorities and aims and objectives across the transition period; the appointment of experienced individuals to new Council roles, following a handover period of up to 12-months.

Key Performance Indicators

Progress against key performance indicators, set in accordance with the University Strategy 2019-28, is summarised in the table below. Further below is a commentary on those indicators where we are performing well, improving or continuing to work hard on to see the performance to which we aim.

| |

Completion of 2023-24 Target |

Latest Data |

Performance at completion of 2023-24 |

Performance at completion of 2022-23 |

Rank |

Value |

Rank |

Value |

1 - TGUG Rank1 |

30th |

TGUG 2025 |

46th |

636 |

56th |

594 |

Guardian University Guide |

- |

GUG 2025 |

23rd |

63.7 |

30th |

63.5 |

Complete University Guide |

- |

CUG 2025 |

30th |

741 |

32nd |

712 |

Daily Mail University Guide |

- |

DMUG 2025 |

44th |

726 |

41st |

722 |

2 - THE-WUR Rank |

250th |

THE-WUR 2025 |

361st |

50.8 |

326th |

52.0 |

3 - TEF |

Gold |

TEF 2023 |

Silver |

Silver |

Silver |

Silver |

4 - Student Satisfaction |

25th |

TGUG 2025 |

39th |

82.3 |

80th |

73.0% |

5 - Graduate Outcomes |

25th |

TGUG 2025 |

91st |

72.1 |

77th |

75.2% |

6 - Student Outcomes (E&D)

a. Progression |

<10% |

2023-24 Entrants |

- |

35.7% 2 |

- |

36.8% |

6 - Student Outcomes (E&D)

b. Good Degrees |

<10% |

2023-24 Leavers |

- |

25.7% 2 |

- |

24.4% |

6 - Student Outcomes (E&D)

c. Graduate Outcomes |

<10% |

2022-23 Leavers |

- |

12.1% |

- |

3.3% |

7 - Research Degree

a. Completion |

70% |

2023-24 |

- |

92%2 |

- |

92% |

7 - Research Degree

b. Awards |

0.23 |

2022-23 |

- |

0.22 |

- |

0.20 |

8 - Research Quality |

20th |

TGUG 2025 |

41st |

50.0 |

41st |

50.0 |

9 - Citation Rates |

40th |

2019-23 |

81st |

11.1 |

81st |

10.2 |

10 - Research Income

a. Income/Staff FTE |

20th |

2022-23 |

43rd |

£51,487 |

43rd |

£48,649 |

10 - Research Income

b. Income from Industry |

£10.6m |

2022-23 |

14th |

£4,954,000 |

14th |

£4,539,000 |

10 - Research Income

c. HE-BCI Income |

£34.1m |

2022-23 |

9th |

£37,064,000 |

12th |

£28,460,000 |

11 - Financial Sustainability

a. Cash Surplus/Deficit |

1.0%3 |

2023-24 |

- |

1.7% |

- |

5.8% |

11 - Financial Sustainability

b. Institutional Liquidity Days |

60 |

2023-24 |

- |

141 |

- |

169 |

11 - Financial Sustainability

c. Institutional Borrowing |

>1.5 3 |

2023-24 |

- |

1.57 |

- |

3.6 |

1. KPI-01: Council approved the change to the KPI-01 target (top 25) to Top 30 by 2028 – approved Spring 2023

2. KPI-06a, -06b, -07a: Are subject to change as data finalises through the autumn term

3. In the new financial environment, Council approved changes to the targets for KPI-11a Cash Surplus (2028 2% and, exceptionally, 1% for 2023-24) and KPI-11c (1.5x).

Consistently performing well

- KPI-10b – Industry Income. This year we recorded our highest ever industry income figure showing consistent years of strong growth either side of the pandemic, and an immediate bounce back from the disruption caused by the pandemic. This latest income is 191% of the 2019 baseline figure.

- KPI-10c – HE-BCI Income. This year we recorded a substantially improved income figure, our highest ever, showing an immediate bounce back from the disruption caused by the pandemic, and far surpassing the target for this KPI for the first time (to be above the average of the benchmark group). This latest income is 143% of the 2019 baseline figure.

- KPI-07a – Research Degree Completion. This is, and has remained throughout, well above the target, having remained at over 90% (this year, 92%) for three years now.

- KPI-06c – Student Outcomes (E&D) Graduate Outcomes. This KPI measures the extent of gaps for students achieving high level employment/further study in 6 protected characteristics. Although the proportion of gaps across our departments, across five characteristic groups of students, has risen slightly this year, it remains at a very low rate (representing just 8 gaps out of 66 instances), with every year since baseline being in single digit number of gaps.

- KPI-11a, -11b, -11c – Financial Sustainability. Given the exceptional deterioration in the UK Higher education funding environment, the University Council agreed to reduce the cash surplus target (KPI 11a) from 5.5% to 1.0% for 2023-24 and 2.0% for each year thereafter, subject to annual review. For 2023-24, the revised target was exceeded with a cash surplus of 1.7% of total income. Targets were also exceeded for KPI 11b (60 days of liquidity) and KPI 11c (EBITDA of not less than 1.5* debt servicing).

Steady improvement

- KPI-01 – TGUG Rank: improved by 10 rank positions this year, to 46th. This is our highest ranking in four publications and is our first rank rise in seven iterations, since the 2018 guide. Much of the fall in rank since that point can be attributed to successive methodology changes that have accompanied each release, including the removal of the Services/Facilities Spend metric (which Essex would have ranked 1st for in the previous two iterations), and the continued use of historic datasets including NSS 2022 (instead of NSS 2023) and pre-pandemic entry tariff scores.

- Other domestic league tables: We use the TGUG as a way of benchmarking and monitoring our performance, but there are three other domestic league tables (the Guardian University Guide, Complete University Guide, the and the new Daily Mail University Guide) that we also monitor. In the Guardian University Guide (GUG), we were ranked 23rd, a rise of 7 places on last year and a 62-place rise over the past four publications. Again, we were ranked 4th nationally in the Guardian’s Value-Added metric – a metric that indicates the extent to which a student exceeded expectations, based on entry qualifications. In the Complete University Guide (CUG), we moved up two places to 30th in this year’s iteration. This included ranking 3rd nationally for facilities spend and 4th nationally for academic services spend. We are also 30th for research intensity. In the second iteration of the Daily Mail University Guide (DMUG), were ranked 44th having ranked 41st last year.

- KPI-04 – Student Satisfaction. Having not used it in 2023, the TGUG did include the new version of the NSS this year, using an aggregate of NSS 2023 and 2024. This resulted in a rank rise of +41 places on the Student Satisfaction metric, to 39th. This includes rises of +42 places in the Teaching Quality half of the metric and +28 for the Student Experience half of the metric (which now ranks 25th).

- KPI-07b – Research Degree/Staff FTE. This year saw a small rise in value, with a large rise in rank (+9). This increase is driven by an increase in the number of awards this year, coinciding with a small increase in staff FTE.

- KPI-08 – Research Quality. Now using REF 2021, this score and rank will remain static for the next four publications of the TGUG. A conscious decision was made to provide a REF submission that maximised our QR funding potential of the submission, which is not always compatible with improved performance in the TGUG metric. This approach was successful and our recurrent research grant increased by £4.5m a year. Good progress is being made with early substantial preparations for the next REF that will take place in 2027-28.

- KPI-09 – Citation Rates. We have seen consistent year on year growth in the citations per publication value, and although the rank has remained static this year, this represents the first year that we have not fallen in rank despite value increases – this suggests that we have eventually caught up with the sector and our competitors, having started from a considerable distance. Encouragingly, the size of our growth continues to exceed the growth of the sector. Scopus (the same database that we obtain the KPI data from), introduced a new metric termed, ‘Field Weighted Citation Index Median’, which takes into account outlier publications (publications that sit well above the norm). In this, Essex rank 47th in the sector – considerably higher than both our KPI, 81st and a similar metric we monitor, ‘Field Weight Citation Index’, 66th.

- KPI-10a – Research Income/staff FTE. Although the rank position remained static, this year saw this metric rise for the first time in the strategic plan period. This is a result of massively growing Research income which this year hit an all time high of £34.33 million (+£4.2m on last year). This latest research income figure is 113% of the 2019 baseline figure. This research income figure is expected to rise again in the next reporting period.

Work in Progress

- KPI-02 – THE-World University Rankings (WUR). We have fallen into the 351st–400th bracket, our lowest ever ranking. Although our specific rank is not published, we are able to self-calculate this to a strong degree of confidence and find we now rank 361st (having ranked 326th last year). Of UK institutions ranked in this table, we moved down 3 places to 39th. Within this table, we are 17th in the world for ‘International Outlook’.

- KPI-03 – TEF. We were awarded Silver in TEF 2023, as well as Silver awards in both elements: student experience and student outcomes. This will now remain until the TEF 2027 exercise. As this TEF cycle assessed the period 2018-22, we now have 2023 and 2024 performance data to assess at an early stage the performance that will underpin the next TEF submission in 2027. This early insight shows the latest data, that which will constitute the first two years of the next cycle, sits materially above benchmark on two sections ‘Learning Resources’ and ‘Organisation and Management’, with a further six sections above benchmark. No overall metrics are regarded materially below benchmark. Therefore, this is – so far – improved performance on our TEF 2023 dataset.

- KPI-05 – Graduate Outcomes. Having previously seen recovery following the pandemic period, We fell further behind the sector in the most recent year, falling 14 places to 91st in the TGUG. Robust plans are in place for and Graduate prospects/outcomes to return to the upwards trajectory in score, hopefully seeing rank improvements subsequently.

- KPI-06a – Student Outcomes (E&D) (Progression). This KPI measures the gaps in progression rates across five protected characteristics for students successfully moving from their first year of study to their second. Over the past two years, we have reduced progression gaps significantly, marking a strong improvement in equitable progression.

- KPI-06b – Student Outcomes (E&D) Degree Classifications. This KPI monitors attainment gaps across five protected characteristics in achieving 2:1 and 1st class degrees. We have made good progress in narrowing and/or eliminating the attainment gap between some characteristics, but there is still work to do in some areas. We continue to monitor progress and address this important issue.

2023-24 Financial Statements

Income 2023-24

Expenditure 2023-24

Student and staff numnbers

Liquidity days

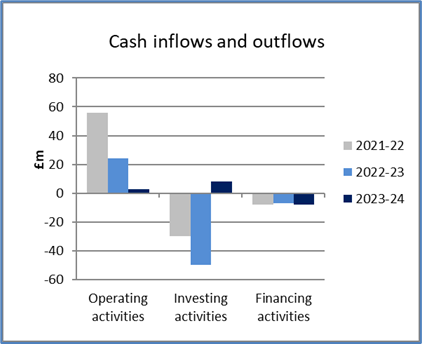

Cash inflows and outflows

Capital investment

Public Benefit Statement

Our charitable aims

Our Royal Charter sets out the objectives which form our charitable purpose “to advance education, scholarship, knowledge and understanding by teaching and research for the benefit of individuals and society at large”.

Our University Strategy 2019-28 states that

- Our purpose is to benefit individuals and communities through excellence in education and research.

- We will put student success at the heart of our mission, supporting students from every background to achieve outstanding outcomes; preparing our students to thrive in their future lives and nurturing our community of educators to support and promote student success.

- Our research will continue to focus on asking difficult questions, challenging conventional wisdom, tackling with rigour the questions that matter for people and communities and putting ideas into action to improve people’s lives.

- We will be recognised nationally and globally for the quality and impact of a transformative education, and for the international excellence and world-leading quality, scale and impact of our research.

- We will nurture and celebrate our shared commitment to social action, supporting every person in our university community to realise the potential of their Essex Spirit through their contribution to our shared mission.

- We will have grown the University to achieve transformational research through our community of researchers and extend our knowledge base by investing in new disciplines that meet the needs of our time and to ensure the financial sustainability of the University.

Beneficiaries of our work

Our research and education contribute to improving people’s lives in the UK and internationally.

Our students are the main public beneficiaries of our work in education and research. We provide a transformational educational experience, encompassing both academic and extra-curricular activities, to enable all our students to fulfil their potential. Our global community of over 130,000 alumni, drawn from more than 140 countries, is taking their Essex Spirit out into the world and making change.

Other beneficiaries include companies, organisations and charities that employ our graduates, work with our academics on knowledge exchange projects, and access our training programmes.

Wider society benefits from the insights provided by our world-leading research in the social sciences, science and health, and the arts and humanities. Our work also makes a growing contribution to the local economy, underpinning the success of our region.

Governance

Members of Council are trustees of the University and our decision making pays due regard to the definition of public benefit outlined in the Charities Act 2011 and the Charity Commission’s guidelines on charitable purpose and public benefit, in particular, The Advancement of Education for the Public Benefit (Charity Commission, December 2008) and Public Benefit and Fee Charging (Charity Commission, December 2008).

We’re a Civic University

We are committed to enhancing the prosperity and wellbeing of communities across North Essex through our Civic University Agreement, signed in partnership with Colchester City Council, Tendring District Council, Essex County Council, and the North East Essex Health and Wellbeing Alliance.

This agreement aligns with the national Civic University Network’s mission to ensure universities make a meaningful impact within their communities, embedding civic aspirations into their work to drive positive social change.

The launch event in October 2023 showcased key partnerships, including the Centre for Coastal Communities, the Heart of Greenstead, the Essex Centre for Data Analytics, and Freeport East.

Awards and rankings

Our excellence in research and education was recognised in 2023-24 with notable awards and high rankings in key national and international assessments.

In 2024, we were ranked 58th in the global Times Higher Education (THE) Impact Rankings out of 2,152 universities across 125 countries for our work in support of the United Nations Sustainable Development Goals.

We are hugely proud of our Students’ Union, and were especially delighted when its VTeam volunteering programme was awarded the King's Award for Voluntary Service in 2023 - the highest national award a voluntary group can receive in the UK.

We are now one of the UK’s top 30 sporting universities, having achieved our highest ever ranking and points score in the British Universities and Colleges Sport table.

Continuing to lead in industry collaboration, we remain the number one UK university for active Knowledge Transfer Partnerships (KTPs), the flagship Innovate UK programme that connects academic research with businesses to develop new products and services.

Recognising the strength of our KTPs, we won the Best Management KTP award for our partnership with The Finishing Line, and Essex KTP Associate, Rodolfo Cuan Urquizo, won the Future Leaders Award at Innovate UK’s annual Knowledge Transfer Partnerships (KTPs) awards ceremony in Cardiff.

We also maintained our strong reputation as https://www.essex.ac.uk/news/2023/10/03/essex-is-one-of-the-top-uk-universities-for-partnershipone of the top UK universities for partnerships, ranking 14th out of 139 institutions in the Government’s Knowledge Exchange Framework (KEF), which measures the national impact of universities.

Our vibrant and impressive international community and commitment to global research collaborations contributed to Essex moving up to 15th for international outlook in the Times Higher Education World University Rankings.

The 2021 Research Excellence Framework (REF) confirmed our position as a powerhouse for social sciences research. We are ranked in the top 10 in the UK for research quality in economics and econometrics, modern languages and linguistics, politics and international studies, and sociology. We were also ranked in the top 10 for research impact in computer science, economics and econometrics, law, politics and international studies, and sociology.

Essex in Europe

We continue to be part of the Young Universities for the Future of Europe (YUFE) Alliance, one of the dynamic European University Alliances, selected by the European Commission. The Alliance enriches and enhances learning opportunities (including extra-curricular training activities) for the students enrolled across the network of ten European universities.

We have continued to lead the Alliance’s important diversity and inclusivity work, which is embedded across all its activities. In December 2023, we hosted a three-day conference, bringing together colleagues from across the YUFE alliance to collaborate on the partnership's mission to advance equity, diversity, and inclusivity.

We’ve also been involved in YUFE’s newest spin-off, BioYUFE, which allows any Master’s student at a YUFE university undertaking a biology or life science programme to be eligible to enrol for optional BioYUFE courses at partner institutions.

Essex is also part of YERUN – the Young European Research Universities Network, which brings together 23 like-minded young universities from across Europe, with the aim of strengthening and developing cooperation in research and academic training to benefit society.

As an active participant in the Research Matters Campaign, YERUN is part of a major collaboration between European universities, research organisations, funding agencies, industry partners and communication professionals. This campaign advocates for increased funding and recognition for research and innovation, uniting stakeholders in a common cause.

Education at Essex

We believe that learning extends beyond a student’s degree programme, so we offer a number of additional learning opportunities to complement our courses. Languages for All gives students access to language courses as part of their undergraduate degree at no extra cost. Data for All is designed to give all students, regardless of their previous experience, the chance to develop valuable data skills. Other strands are being developed as part of the wider Essex for All programme.

In September 2023, we received a silver rating in the UK Government’s Teaching Excellence Framework (TEF) in recognition of our “very high-quality education”.

We were shortlisted in the Times Higher Education Awards 2023 in the Outstanding Support for Students category for our Essex Preparation Programme, which is driving up engagement and retention and giving students greater confidence as independent learners.

Dr Rebecca Warren, inspired by her own experience as the first in her family to go to university, developed the Democracy in Action module and was subsequently shortlisted for the Most Innovative Teacher Award.

Our career development initiatives include our career mentoring programme, online careers events, and 1-1 support, alongside work placements, internships, and study abroad opportunities to help broaden our students’ horizons and equip them with valuable experience and skills. This includes our Frontrunner scheme, which offers part-time internships specifically designed for students with little to no work experience, giving them a chance to develop practical skills in a supportive environment. These initiatives not only benefit students but also enable businesses to tap into their knowledge, skills, and expertise.

We were one of just four universities to be shortlisted for the Supporting Student/Graduate Employability category in the AGCAS Awards for Excellence for the Chart My Path online portal, which was pioneered at Essex and which features over 190 activities aimed at helping students gain skills.

A collaboration between the University’s Industry Engagement and Placements team and Essex County Council was also shortlisted for the AGCAS Award for excellence in careers and employability service engagement in 2024. The partnership aims to offer students opportunities to enhance their workplace skills and includes an innovative, work-based learning module hosted by the Department of Government.

We believe our graduates benefit society, and the companies and organisations they work for, thanks to their research mindset, critical thinking, creativity, intellectual independence, excellent communication skills and leadership ability.

To ensure our students get the most innovative teaching, we encourage ongoing staff development and we celebrate success through annual Excellence in Teaching Awards. Academics also can gain professional recognition as Fellows of the Higher Education Academy (HEA) through our CADENZA programme.

New facilities

The University is making significant capital investments on the Colchester Campus with the opening of the Health, Wellbeing and Care Hub allowing students, academics, and health professionals to work together to provide innovative and integrated services to local people. This includes extensive placement opportunities for students, and research opportunities across nursing, oral health science, occupational therapy, physiotherapy, speech and language therapy, social work, clinical psychology, law, sports science, computing and related subjects.

In 2024, a new state-of-the-art indoor crop growth facility – the Smart Technology Experimental Plant Suite (STEPS) – opened in the School of Life Sciences. With one of the longest established whole plant physiology and photosynthesis groups in the UK, we’ve long been at the forefront of plant productivity research. This £3.5million facility enables plants to be grown in a suite of fully automated and adjustable environments, including dynamic tuneable lighting systems capable of replicating natural outdoor environments in real time, with fine-scale regulation of temperature, humidity, water availability and CO2 concentrations. An experimental, commercial-standard, vertical farm will further expand Essex’s research, expertise and knowledge in indoor plant growth.

The School of Health and Social Care has opened new skills labs and simulation spaces at both the Colchester and Southend campuses, allowing students to learn and practice the specific technical skills needed in clinical practice. The evolving development of simulation tools will also allow students to undertake high-fidelity simulation in scenario-based learning opportunities.

The School of Life Sciences has also created a new Aquatic Ecology Facility to support education and research into a range of aquatic organisms (e.g. coral, oysters and fish) and their associated microbiomes to address global challenges associated with fish and shellfish stocks, habitat restoration and climate change.

The School of Sport, Rehabilitation and Exercise Sciences has seen its facilities extensively refurbished and now boasts a wide range of modern labs for sport and exercise, physiotherapy and sports therapy students. The teaching, learning and research facilities now available in the School include physiotherapy labs, sport therapy labs, a sports psychology lab, a biochemistry lab, a biomechanics lab, an exercise physiology lab, and a human movement lab, as well as the Human Performance Unit with its impressive performance analysis technology.

Supporting the next generation of researchers

We are a leader in doctoral training and in developing the next generation of researchers. We are part of several doctoral training partnerships offering training and funding:

Through these initiatives we work with other leading higher education institutions to promote excellence in research, postgraduate research training and knowledge exchange. We are also a member of the Eastern Academic Research Consortium which provides opportunities for collaborative research and studentships in quantitative social science, digital humanities and synthetic biology.

In 2023-24, the Sustainable Transitions - Governance, Ecological Management and Society - Leverhulme Doctoral Training Programme was launched, bringing together our world-leading disciplines of life sciences, law, sociology, government and business. The programme and aims to train the next generation of interdisciplinary doctoral scholars with the skills and expertise to contribute to ‘sustainable transitions’ at local, national, and international levels.

Meeting different study needs

We offer various routes to an Essex degree to meet the needs of different learners, working with partners around the world to extend higher education opportunities.

We have an expanding programme of Higher and Degree apprenticeships, from our schools of Computer Science and Electronic Engineering, Health and Social Care, and Sport, Rehabilitation and Exercise Sciences. These programmes offer an alternative route into higher education, and we are working with employers to increase the number of apprenticeship places offered through Essex.

For those who want to study remotely, we offer undergraduate and postgraduate degrees, in collaboration with Kaplan Open Learning, through University of Essex Online and, through our growing network of global partnerships, students can also study for an Essex degree abroad, at institutions such as Aegean Omiros College in Greece, Beaconhouse International College in Pakistan, and Laksamana College of Business in Brunei.

Making a difference in our communities

For over 20 years, our students, supported by the Students’ Union, have been making change happen though the VTeam volunteering programme - giving their time, energy and talents to a host of projects to make a genuine and lasting difference to a wide range of communities.

Since 2016, over 6,700 students have logged 187,441 hours of volunteering, and this remarkable commitment earned the VTeam volunteering programme the King's Award for Voluntary Service in 2023.

VTeam delivers one-off projects and on-going initiatives, benefitting multiple generations, from young people through school clubs like Einstein, Lingo and Coding, to schemes supporting refugees with language skills and projects helping the elderly in residential homes. Essex Law School and the Human Rights Centre run several initiatives that support local communities, including the Human Rights Local project, which shows how human rights are closely linked to everyday life by working with local and community groups, local authorities and other stakeholders, and the Essex Law Clinic which offers free legal services to the local community, and educates people about their legal rights and obligations.

An inclusive community where everyone can succeed

We admit students on the basis of their merits, abilities and potential, regardless of race, ethnicity, gender identity, disability, age or other irrelevant distinctions, and our living and learning environment provides opportunities for everyone. We ensure all students have equal opportunity to succeed both during their time at university and after they graduate. That’s why we provide employability opportunities for everyone and support for under-represented groups in getting the experience they need to secure graduate level jobs.

We are also a University of Sanctuary committed to promoting a culture of welcome, safety and inclusion across our campuses and their wider communities. Among the many activities we undertake to support this work, our Sanctuary Scholarships support students who are refugees or seeking asylum to study for Postgraduate Taught Master’s degrees. We have also signed the Gypsy, Traveller, Roma, Showman and Boater (GTRSB) Higher Education Pledge to help raise awareness of the history and culture of the GTRSB community and to support GTRSB students in the community as well as GTRSB students on our campuses.

Our Transitions and Transformations: Black Researchers Journey project, supported by funding from Research England, continues to tackle persistent inequalities that create barriers for Black, Asian and minority ethnic students to access and take part in postgraduate research.

Research at Essex

Beneficiaries of our research

- Students benefit from our research-led teaching.

- Government bodies, non-governmental organisations and regional, national and international businesses benefit from our knowledge exchange and partnership opportunities.

- Individuals and wider society benefit from our research which engages with current issues to improve the quality of people’s lives and inform debates and policy development and implementation.

In 2023-24, our research income once again increased to reach an all-time high of £37.5 million, illustrating our success in attracting research grants at UK and international levels.

Our research strengths were highlighted in spring 2022 when the results of the Research Excellence Framework (REF) 2021 were published. This consolidated our reputation as a powerhouse for social sciences. We were ranked in the top 10 in the UK for economics and econometrics, modern languages and linguistics, politics and international studies, and sociology for research quality (Grade Point Average, REF 2021). Additionally, we were ranked in the top 20 for art history, law, and philosophy (Grade Point Average, Research Excellence Framework 2021), and in the top 10 in the UK for research quality for computer science, economics and econometrics, law, politics and international studies, and sociology (Times Higher Education 2022).

Communicating our research excellence

In November 2023, we took part in the national Being Human Festival. Dr Jordan Savage organised The Hungry Human series of events about food, story, history, and migration in Essex. This project had three main objectives:- to share our humanities food research; to encourage dialogue between different communities with an interest in food; and to use food as a way of helping people to share their voices and tell their own stories.

In June 2024, we supported the Essex Book Festival. Our academics took part in multiple events across the county, and we hosted a special day of activities at our Colchester Campus to mark our 60th anniversary and 25th anniversary of the Festival.

In Colchester, our postgraduate community once again organised the Pint of Science Festival across venues in the city centre, with scientists giving talks in packed pubs and bars to give the public insights into our science research.

Our Professorial Inaugural Lectures have continued in 2023-24, after being relaunched post-COVID. This series of regular public lectures are usually delivered on our Colchester Campus and give the public the chance to hear about the work of newly appointed professors.

The public can also engage with our research through our online activities. We are a partner of online news site The Conversation, which publishes news and views written by researchers. As of August 2024, our academics have contributed almost 861 articles, which have been read more than 27.2 million times globally. Our researchers also engage with print, broadcast, and online media to inform public debates about everything from air pollution to international relations, and publish their work in internationally recognised journals and via our University of Essex Research Repository.

Our global research agenda

Our research agenda tackles local, national, and international challenges. We have a global reputation in human rights, social scientific research, and data analytics and, notably, in 2013, Her Majesty the Queen conferred a Regius Professorship of Political Science on Essex, recognising 50 years of excellence in research and education in political science. We continue to expand the scope of our research, and, through our flagship centres and institutes, we foster interdisciplinary collaboration, enabling academics to produce research that delivers practical insights and real-world impact.

In June 2024, we launched a new Centre for Behavioural Science, creating new opportunities to expand partnerships and increase our impact in the study of behavioural science. The Centre is supported by over 120 members from across the University’s arts and humanities, social sciences, and science and health communities, fostering interdisciplinary collaboration and innovation.

The launch of our Centre for Healthcare Science in June 2024 brought together key partners from NHS England, NHS integrated care systems and trusts in the East of England, the National School of Healthcare Science, local secondary schools and further education colleges. This collaboration aims to raise the profile of healthcare science from a school-age level, establishing an East of England centre of excellence, and providing opportunities for training, future workforce development, and upskilling the existing workforce, while developing research and scholarship in the area. By fostering innovation, training, and research in healthcare science, this collaboration strengthens our ties with healthcare providers, enhancing the region’s capacity for excellence in this field.

Our Centre for Global Health and Intersectional Equity Research was launched in April 2024 to help academics and health professionals tackle global health challenges. The Centre will ensure policy makers and health professionals have access to the latest research, tools, methods, and data that can help protect the world’s most vulnerable people.