Quick links

Chair’s Introduction

We have much to celebrate in the last academic year, as the University has bounced back strongly from the impact of the pandemic, and we look forward to celebrating our 60th anniversary in the coming year. We take the sustainability of the University in all its forms very seriously and I am delighted that we have been able to meet out cash surplus target (measured as the surplus for the year plus non-cash transactions (depreciation and movements in investment property valuations, fixed asset investments and provisions) less capital grants and loan principal repayments) two years earlier than anticipated in our post-pandemic recovery plan. Growth in tuition fees, an increase in research income and a recovery in campus trading activities have been key components of our performance recovery. Generating a cash surplus is vital in creating headroom for us to reinvest in the academic mission of the University, including in academic and professional services staff, and updating our research and teaching infrastructure, especially specialist facilities that allow us to respond to student demand for courses.

Anticipating a slow recovery for undergraduate student recruitment, in part as a result of the pandemic, a 65% reduction in undergraduate student registrations from the EU as a result of Brexit, and the freezing of the UK undergraduate fee, the University is benefiting from a student recruitment diversification strategy launched in 2016 and which has evolved into our Essex 2025 project. This project is fully supported by the University Council and ably led by the University executive. I am delighted our student numbers have almost recovered to the total student population that we had in 2020-21 with 19,090 students this year.

We have increased students registered on our postgraduate and research degree programmes, Students on our Postgraduate Taught (PGT) programmes have increased to 5,620 students, more than double the 2,240 in AY 2019-20. The profile of our student population is now 5% Postgraduate Research (PGR), 30% PGT and 65% Undergraduate (UG). In 2021 we successfully launched a January entry point for 10 Postgraduate Taught courses across five departments. In January 2023, 939 students registered on courses and from AY 2023-24 10 departments will offer 17 Postgraduate Taught courses with a January start. In AY 2022-23 we announced the largest investment in research degree scholarships in our history and expect to grow admission to our postgraduate research community in AY 2023-244 by 118%.

The University is committed to offering a cosmopolitan and international educational experience, where you really can find the world in one place. To this end we have invested in five regional international offices around the world, and we recruit students from around 130 countries. In managing risk, we have been careful to ensure a diversified portfolio of international recruitment and to avoid overreliance on students from one country. Our total fee income has increased by 12% to £196.7m and fees from international students are now £107.7m, an increase of 47%. With the UK fee frozen at 2018 levels, our ability to recruit international students is vital in allowing us to cross-subsidise UK undergraduate teaching and in ensuring our financial sustainability.

Tuition fee income for AY 2022-23 was above target and we remain hopeful this will be the case for AY 2023-24. Nonetheless we are concerned that our intake of home undergraduates fell for the third year in a row. With improving league table rankings, we will be leaving no stone unturned in ensuring that we recruit our fair share of the growing numbers of potential students in London and the eastern counties and from across the United Kingdom for 2024-25.

Financial Sustainability

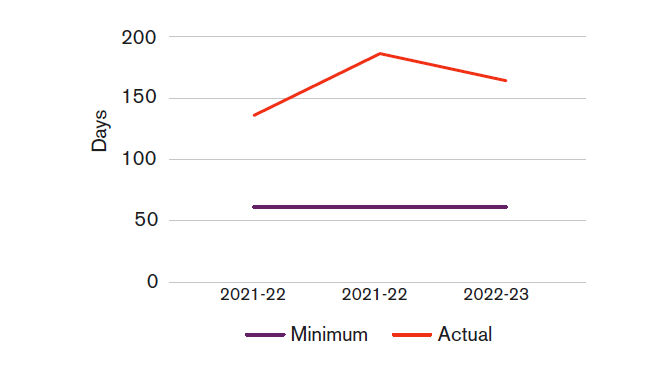

The University Council has set a requirement for a minimum of 60 days liquidity which we exceeded with 169 days due to holding £120.8m in cash and deposits and having £40m available from our revolving credit facility with Santander. This leaves us well positioned to continue to refurbish and enhance our estate and infrastructure for teaching and research. As we have paid back loans, our total long-term borrowing has steadily reduced to £140.6 million. The University has been fully compliant with all our banking covenants, and we are on track to remain so. Over the past decade we have grown from being one of the smallest multi-faculty universities in England, to medium size, bringing economies of scale that are essential for our financial sustainability.

The University declared a climate and ecological emergency in December 2020 and has set a date of 2035 to reach net zero scope 1 and 2 carbon emissions. Our Sustainability Sub-strategy sets the aims, objectives and actions to reduce our carbon emissions and further our sustainability work. We have increased the capital committed to carbon reduction work over the next five years and grown the teams working on sustainability and carbon reduction. Our scope 1 and 2 carbon emissions have reduced by almost 17% from a 2019 baseline of 12,500 tCO2e, demonstrating the significant progress being made.

University League Tables

Our improvements across a broad range of performance measures were reflected in the three major domestic league tables. In the Complete University Guide we rose to 32nd (an improvement of seven places) and we were ranked 30th in the Guardian University Guide (an improvement of 12 places this year and a rise of 55 places over the past three publications).

Of particular importance to us – reflecting our commitment to social mobility – we ranked 4th for ‘value added score’ in the Guardian University Guide – a rise of 2 places on last year, and 74 places in two years (from 78th in 2022). The intention of the ‘value added score’ is to assess how departments supported students towards getting good grades, and the extent to which a student exceeded expectations, based on entry qualifications. Regrettably the Times Good University Guide has undergone substantial changes to its methodology, including the complete removal of facilities spend and the use of National Student Satisfaction data from August 2022 rather than the latest data in August 2023.

Education and the Student Experience

The University of Essex Strategic Plan sets out our vision to “put student success at the heart of our mission, supporting every student from every background to achieve outstanding outcomes; preparing our students to thrive in their future lives and nurturing our community of educators to support and promote student success”. We are committed to excellence in education; welcoming students to the University on the basis of their potential, supporting them to fulfil that potential, and transforming the lives of everyone who chooses to study with us.

With the Teaching Excellence Framework (TEF) shifting in focus to absolute levels of achievement as well as added value, we were pleased to be awarded an overall Silver in the TEF. We have also achieved Silver in both of the new aspect ratings: student experience and student outcomes. Silver indicates that our education has been judged to be very high quality. The panel concluded that “there was strong evidence of typically very high-quality features overall… The panel judged very high-quality to apply to all the provider’s groups of students, including students from underrepresented groups”. The period being assessed was between 2018 and 2022, including the pandemic period. The panel’s judgement was based on metrics from the period (student continuation, completion, satisfaction and graduate outcomes) as well as both an institutional written submission and a student submission.

We were also pleased to see our performance in the National Student Survey (NSS) make a significant recovery, following the pandemic. Times Higher Education (THE) calculated the average score of the 26 questions in the NSS to create a single ‘Overall Positivity Rate’ for mainstream universities. Essex has a score of 80.7%, ranking 28th of English Broad Discipline institutions and just 2.9% from the top 10. All sections (now called themes) show an increase from last year in ranking against the sector including, pleasingly, two areas we have been focussing on this year: a rise of 37 ranking places for the Assessment and Feedback theme and a rise of 31 ranking places for Academic Support. The theme on Learning Opportunities also rose 35 ranking places. It is pleasing to see these rises in ranking, reflecting good levels of student satisfaction. The results do nonetheless indicate some areas where we can do more. For example, despite pleasing rises of 11 and 14 ranking places respectively, the theme on Teaching is still ranked a disappointing 98th and the theme on Student Voice ranks only 72nd nationally. This does not reflect the quality that we aspire to offer. Therefore, we are continuing our efforts to provide high quality teaching, listening carefully to our students’ feedback on how we are doing and developing plans to deliver further improvements.

At Essex we offer a campus based residential experience and are committed to using campus life to create rounded happy and healthy students, well equipped for the world of work, and well positioned to make the world a better place. We want to put Essex on the map for the extra-curricular experience that we offer to our students, through sports, music and arts extra-curricular activities. We are proud of the absolutely vital and positive relationship the University has with our Students’ Union. In the latest NSS it was again ranked in the top 20 of all students' unions in the country and is now firmly established as one of the top students' unions in the UK.

Recognising the importance of nurturing a sense of belonging through events and activities and responding to our changing student profile with more masters and international students than ever before, the SU has run more daytime events than ever and launched art and craft-based ‘SU Makes’ events, for students who want to focus on a quieter activity and different ways to make new friends.

The University and SU took the opportunity to celebrate the 2022 FIFA Men’s World Cup with the SU Football Fest, a month of celebrations across our three campuses registering 10,000 student bookings to watch the games. As well as bringing our diverse community of students together through football, this also provided an opportunity for our community to debate the hosting of the World Cup in Qatar and run an SU Fireworks evening for 4,500 students.

We have promoted a mobile app to help Essex students meet new friends with more than 8,000 connections made through the app and 24,000 messages sent between students in the same period.

The impact of our welcome work delivered by both the Students’ Union and the University has been encouraging, with 98% of first-year students that we surveyed commenting that they had found the University to be either welcoming or very welcoming.

The total number of student-led societies run by the Students’ Union has increased to 125 with more than 3,600 student members between them, over 100 events happening every month and 8,000 hours logged by Society Executives this year. One of our student societies, the Women in STEM society was recognised by being national finalists for Equality and Diversity in the Bright Networks Awards. Responding to the changing needs of our students we have also redesigned our campus facilities to offer the very best experience, with the SU opening four new spaces for students: our new look SU Bar, The Atrium, The In-between, and the Communities Common Room. The University has also refreshed our food offer, opening five street food stalls and created new and refurbished cafés and restaurants.

An outstanding example of our success in building community on our campuses, our Essex Rebels Women’s Basketball team has the largest average number of spectators of any professional women’s basketball team in the UK. At an International Women’s Day event on 11 March, we broke the record for the largest attendance at a women’s basketball league game in the UK, with 1,505 spectators cheering on the team to victory that day. Essex Rebels also won the prestigious ‘Best Gameday Experience Award’ from Basketball England. The Prize for the men’s National Basketball League One, highlighted the “great atmosphere” and popular performances that have wowed crowds all season.

We remain committed to re-inventing and updating our approach to campus life, to create an even more exciting and re-invigorated experience and have a wide range of initiatives underway in AY 2023-24.

In the light of increasing emphasis given by government to the regulatory environment, we have refreshed our detailed risk assessments of the University’s course provision against the definition of condition B3 of registration with the Office for Students. We found that our data on student success continues to match up well against these targets and we are ever more vigilant to ensure that our students receive the transformational Essex education that they deserve.

Research and Knowledge Exchange

Our 2019-2028 Strategic Plan commits us to growing the number of researchers to around 1,000 for the next Research Excellence Framework. We submitted 702 researchers to the Research Excellence Framework (REF) 2021 (up from 339 for REF 2014) and reflecting our performance our Quality Related (QR) core research grant has increased by £4.4m per annum – representing a 63.5% increase in QR income against a sector average increase of 19.3%. In addition, income from research grants and contracts has increased to a record £34.3m and is forecast to grow to £39.9m for AY 2023-24, an increase of 16.3%.

Putting research into action for the benefit of society is part of the DNA of the University. We put nearly £600 million into the regional economy annually and as part of this commitment, we have been working hard to establish an even wider range of connections to business and the public sector over the past few years. As a result, our consultancy has more than doubled over the past four years. Key achievements include:

- Securing £60 million investment for the Knowledge Gateway research and technology park, which includes Parkside Office Village and the Innovation Centre, which forms a regional hub for innovation and a new 40,000 square foot building. This building will be home to our Institute of Public Health and Wellbeing and new health and wellbeing hubs open to the public.

- Consolidating our top position in the UK for Knowledge Transfer Partnerships with a portfolio of more than 40 initiatives worth £10m which highlights how we are delivering substantial value to UK business.

- Leading the evaluation of the impact of projects, including ‘A Better Start Southend’, a programme supporting children in areas of deprivation, and an innovative Internet of Things project involving five south London boroughs.

- Enhancing the work of our Angels@Essex platform, developed with University Enterprise Zone funding, which matches investors with businesses needing funding. So far 38 businesses have shared over £19m and a further £9.5m has been raised in an additional 15 funding rounds.

- Establishing a unique £500k partnership with the East Suffolk and North Essex NHS Foundation Trust, to use state-of-the-art modelling, machine learning and data analytics to deliver improvements to their hospital services.

- Being a founding partner of Freeport East based at Harwich and Felixstowe and supporting new clean energy businesses and the offshore wind industry.

- Collaborating with Tendring District Council in the award of £19m from the Leveling Up Fund to create a Clacton Civic Quarter, which will rejuvenate a key area of the town including the creation of a University of Essex Centre for Coastal Communities based in the town. We hope this will become a national centre of excellence for seaside town regeneration.

We ranked first, again, out of all universities in the UK for the number of Knowledge Transfer Partnerships we have been awarded with a portfolio of more than 40 initiatives worth £10m. In the latest Government review of Universities and their Knowledge Exchange activities, we were ranked 3rd in our comparator group and 12th overall in the UK for our performance across a range of areas. We featured in the top 20% for our work with the public and third sector and for our performance in terms of commercialisation. And we were in the top 40% for work on local growth and regeneration, public and community engagement, working with businesses, and graduate start-ups. These achievements fed directly into our Higher Education Business and Community Interaction Survey (HEBCIS) return which, in turn, determined how much Higher Education Innovation Fund (HEIF) grant we received. In 2018-19, our HEIF allocation was £2.1m. In 2022-23, as a result of our continual improvement in Knowledge Exchange our HEIF grant almost doubled to £3.77m – our highest ever allocation.

Cost of Living

External research suggests nearly 20% of students in the UK have considered dropping out of their courses because of concerns over money. Working with our Students’ Union, we responded quickly with a package that included:

- Restricting the increase in rent for all University owned and managed accommodation to below the cost of inflation for Academic Year 2022-23, at a cost of £1.3m.

- Establishing our student hardship funding at £1.5m for this academic year.

- Spending £350k on introducing a daily hot meal for £2 in our on-campus food outlets.

- Promoting the wide range of free activities and events available to students.

- Removing the cost of re-sit fees.

- Paying the Voluntary Living Wage for University and SU student jobs.

- Investing £100k to fund 7,500 hours of work in part-time roles for our students in Colchester and Southend.

This amounted to a support package of £4m and the scale and speed of its introduction has received national recognition. This is welcome, but we took the steps we did because it was the right thing to do. Against a significant national decline in students staying the course at other universities, we are also pleased that it has resulted in a very welcome increase in our undergraduate continuation rates.

Other Successes

- We ranked 56th in the world this year (a rise from 76th last year) in the global rankings for sustainability out of some 1,600 universities.

- We ranked 24th for international outlook in the Times Higher Education World Rankings.

- The University of Essex’s beloved Wivenhoe Park has preserved its status among Britain’s top outdoor spaces after winning the Green Flag Award.

- British Council Alumni awards – Essex had 12 shortlisted individuals from nine different countries, two Global finalists, three National finalists, and one National winner.

- Essex has received the joint highest number of shortlisted entries at the Times Higher Education Awards 2023, dubbed the 'Oscars' of higher education. For the first time, Essex has been shortlisted in a total of four categories of the Times Higher Education Awards: International Collaboration of the Year, Most Innovative Teacher, Outstanding Support for Students, and Research Project of the Year (STEM). The outcome will be known in November 2023.

Capital Developments

This year will see completion of a new 40,000 square foot building at the entrance to our Colchester Campus. In addition to being the home of our Institute of Public Health and Wellbeing and new health and wellbeing hubs open to the public, following the success of Parkside Office Village, it will also provide lettable commercial space, strengthening our links with business and the community. Through our Pastures development on our Colchester Campus, 1,262 new study bedrooms will be available from September 2024. The University has increased capacity at our main Colchester Campus by 74% since 2013, reflecting student number growth of 53% in the same period. We are nearing completion of a project to re-clad our student residences at University Square Southend, and we are pursuing legal redress for the cost of this work from third parties vigorously.

Alongside these developments, we have made significant investments in research equipment and new technology to further enable efficient and secure hybrid working.

We have also invested in reshaping our teaching and learning facilities to ensure they are world class including: our Science, Technology, Engineering and Maths Centre which has new state of the art collaborative learning spaces and interdisciplinary teaching facilities, our Causeway Teaching Centre with 15 new teaching rooms over three floors with the ability to provide flexible learning environments; Studio X, our digital creative collaborative studio and student start-up programme, has a state of the art AI/AR, 360 VR Video and animation studios; and we have expanded teaching space for our Health provision which provides teaching capacity for 300 students, including a replica nursing suite, occupational therapy teaching spaces, and consultation training spaces. Future plans include £50m for investments in Teaching and Research facilities over the next five years, as well as another £9m investment in the student experience and student housing. We have also increased and accelerated our investment in sustainable campuses to £14.2m for urgent energy reduction projects and the reduction of carbon longer term.

External environment

In 2020, we took out fixed price contracts for energy until September 2024, and recently fixed them again from October 2024. This has given us some time to maximise our investment in energy generation and conservation to avoid significant increases in costs and enable reductions in our carbon footprint. It was also with good foresight that we arranged a revolving credit facility with Santander for £40 million, incorporating discounts for green initiatives, that we can deploy to address this critical agenda and meet our Climate and Ecological Emergency Commitment to reach net zero by 2035.

In common with many other universities during the pandemic, we delayed our capital investment plan to conserve our cash balances. We have relaunched our re-prioritised plans for refurbishing and improving our infrastructure but are conscious that the value of our cash balances is being eroded by inflation. Therefore, I’m very grateful for the work of our Investment Committee and staff in securing over £3.4m in investment income, in comparison with £0.25m in the previous year.

People

I am delighted that Dr Sarah Perry, author of the Essex Serpent, accepted our invitation to be the next Chancellor of the University of Essex. Our wonderful Vice-Chancellor, Professor Anthony Forster announced his decision to retire at the end of the 2023-24 academic year, having led the University through a period of extraordinary growth and achievement since August 2012. The task of finding a successor to Anthony has begun and we hope to announce an appointee early in 2024. I am sure there will be opportunities to thank Anthony for his contribution as the University enters its 60th year.

I wish to offer my sincere thanks to four outstanding members of Council who concluded their service on the University Council at the end of AY 2022-23. Milan Makwana served on Council from August 2014, completing a full nine-year term of office in July 2023. Milan served as a Pro-Chancellor from February 2019. We benefitted from Milan’s expertise in human resources strategy and management. Alexa Coates joined Council in November 2017, serving over five years. Alexa’s financial expertise was very valuable; providing an authoritative and independent voice in positive meetings with the University’s banks and bond holder during the pandemic to give just one example. Stephanie Hilborne joined Council in April 2019, and made very valuable contributions to shaping our Sustainability Sub-Strategy and our Policy on Tackling Misogyny, Harassment, Sexism, and Sexual Violence Against Women which resulted directly from Stephanie’s insights and understanding of these issues. As President of the Students’ Union (SU), Nashwa Alsakka was a member of Council for AY 2022-23 and we are very grateful for her leadership in supporting students and placing the SU on a sustainable financial footing in the post-pandemic environment.

I would like to welcome four new members to Council: Julie Bentley, Ajit Menon, Mickola Wilson and Alan Newman who joins us as Treasurer designate to enable a smooth handover from Tim Porter with full effect from 1 August 2024. There has been so much happening at the University that time has passed very quickly and it seems extraordinary that this is my sixth year as Chair of Council. While I will miss it very much, I am very happy that the University Council will be in exceptionally good hands when Melanie Leech takes over as Chair on 1 August 2024 when I will have completed the maximum term of nine years as an external member of Council.

We are also grateful to Professor Andrew Le Sueur who concluded six years as Executive Dean for the Faculty of Arts and Humanities, over-seeing the introduction of Edge Hotel School as a successful academic department of the University and the expansion of the Essex Law School to be one of the largest in the country, ranked 3rd for research power.

In conclusion

The University has recovered well from the pandemic, but we are not complacent about the challenges that we face and the fragility of student recruitment. Alongside our Essex 2025 initiative, we continue to have robust planning systems in place, an effective approach to risk management, and are encouraged by recognition of our progress in university league tables. We also know that there is no long-term substitute for strong UK undergraduate student recruitment, and we must capitalise upon our bounce back success by regaining our share of home undergraduate students. It remains for me to thank the Vice-Chancellor and the University executive team as well as staff and students for all their hard work in making AY 2022-23 a very successful year. We have a history of understanding where we came from as well as where we are trying to go. I am delighted that we can look forward to our 60th anniversary year with a great deal of confidence about our future.

Jane Hamilton

Chair of Council

27 November 2023

Highlights from 2022-23

- 19,000+

students (Headcount)

- 8,000+

new students

- 125,000+

alumni

- 1st in the UK for Knowledge

Transfer Partnerships

- TOP 25

for international outlook

(Times Higher Education World

University Rankings 2023)

- TOP 60

in the global Times Higher

Education Impact

Research Power

- 5 subjects in the UK Top 10

(Research Excellence Framework 2021,

Times Higher Education)

- KTP Academic of the

Year Award

Dr Faiyaz Doctor from

School of Computer Science

and Electronic Engineering

(Innovate UK Awards 2022)

Research Quality

- 4 social science subjects

in the UK Top 10

(Research Excellence Framework 2021)

- TOP 30

for positive student

feedback

(National Student Survey 2023,

English broad discipline institutions)

We remain a key member of the Young Universities for

the Future of Europe (YUFE) and the Young European

Research Universities Network (YERUN).

Strategic Report

Objectives and strategy

Our mission is to deliver excellence in education and research, for the benefit of individuals and communities. We are proud to offer a transformational research-led education, welcoming students to the University based on their potential, helping them to fulfil that potential, and transforming the lives of everyone who chooses to study at Essex.

Emerging from the pandemic we are operating in a rapidly changing national and global higher education sector which presents a range of opportunities as global student mobility recommences. In order to maximise the benefits of these opportunities we have invested in flexible and agile systems through our Smart Working at Essex programme, and significantly increased our student-facing facilities, support and teaching infrastructure. This ensures all students have access to the excellent facilities and receive the support they need to succeed. Our recent growth in academic staff who are delivering world-leading research continues to underpin our approach to transformational research-led education. Through continued investment over the last year, we have grown academic staff numbers by 6%, keeping the University on track to achieve 1,000 research active staff by the next REF.

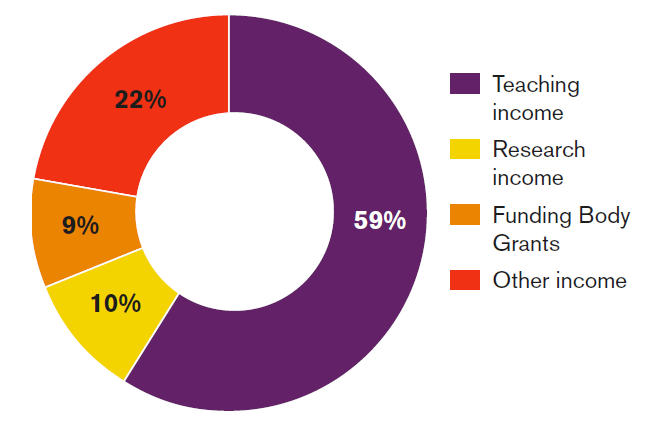

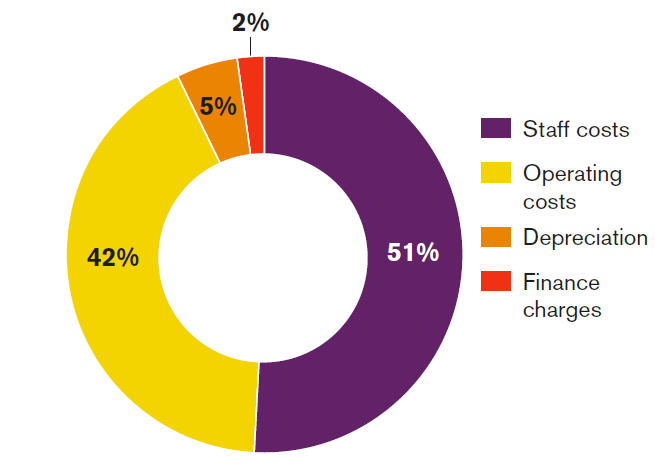

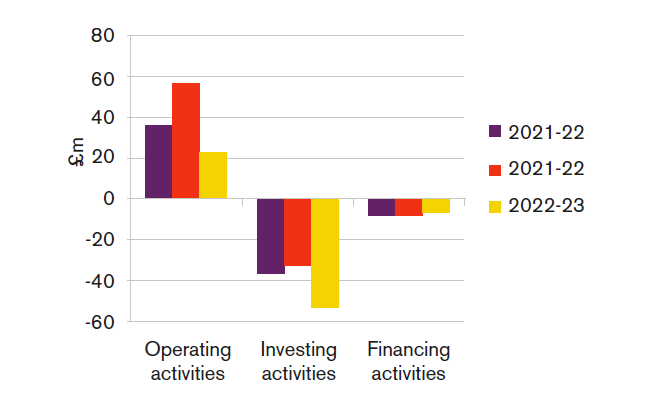

Financial performance during 2022-23

The financial performance of the University remains strong, delivering an accounting surplus of £20.2m and a cash surplus (measured as the surplus for the year plus non-cash transactions (depreciation and movements in investment property valuations, fixed asset investments and provisions) less capital grants and loan principal repayments) of £19.2m (5.8%). Key factors supporting this outcome are increased fee income (up £20.6m year-on-year) and a £4.4m increase in our core research grant, reflecting the financial reward of pursuing our strategy to increase the number of research academic staff submitted to REF 2021 to 701, from 339 submitted to REF 2014. There has been significant investment in staffing to both support the levels of student recruitment achieved in 2022-23, further improve student-staff ratios and to seek to build up future capacity in areas where growing demand can be anticipated. This strategy is reflected by an increase in staffing costs of £16m across the past two years.

Further year-on-year recovery has been experienced within Campus Services, returning to a surplus for the first time since the pandemic. The surplus delivered was £3.7m versus a deficit of £3.5m in 2021-22. The most significant financial improvement across the two years was within Accommodation Essex (Colchester) delivering a surplus of £7m versus a break-even position in 2020-21, reflecting the increased uptake as numbers in accommodation improved following the disruption during the pandemic.

To counter the impact of rising inflation on the University’s cost base, the University was able to secure £3.5m through cash investment & interest returns; this is an increase of £3.3m on 2021-22 (£0.2m 2021-22) and is a result of careful cash management and diligent placement of funds in a range of short and long-term fixed interest instruments, including the Fasanara Capital Global Diversified Alternative Debt Fund.

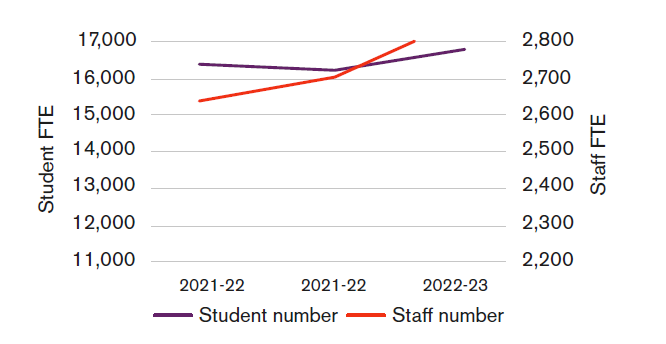

Total student population is close to 16,500, representing an increase of around 2% versus 2021-22.

Our research grant and contract income reached a new record high of £34.3m, growing by 14%, with all faculties surpassing the previous year’s performance levels. The indirect costs recovered from this activity also saw strong growth of 5% rising to £7m, our second highest level since 2019.

| |

2021-22

£000

|

2022-23

£000

|

Year-on-year movement |

| Research

contract income |

30,164 |

34,331 |

+4,167 |

| Research

contract indirect

costs recovered |

6,694 |

7,021 |

+327 |

Increasing academic staff numbers remains a key priority. Over the 12-month period from August 2022 to July 2023, average academic staff numbers increased by 59 FTE (6%) and total staff numbers by 182 FTE (7%). Whilst the very welcome growth in academic staff is very positive, the significant increase in academic staff has and will have an impact on a number of KPIs where we use per member of staff measures to judge progress towards our KPIs, including research income and citations. As staff settle in, we are sure their contribution will impact positively on these KPI measures. We estimate that our HESA reported student to staff ratio (SSR) will improve from 14.6:1 in 2021-22 to 14.3:1 in 2022-23.

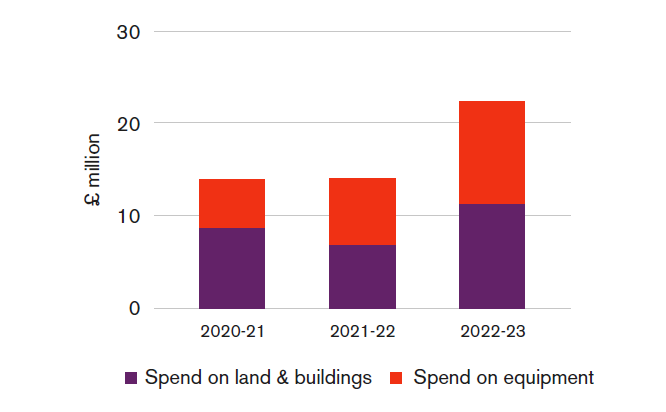

Capital investment

The Capital Investment Plan (CIP) supports the delivery of the University’s Strategy and its commitment to excellence in education and research and to growing to a community of about 20,000 students and about 1,000 research active staff for the next REF.

A revised CIP was agreed by Council in July 2023. Included within the CIP are projects to support the growth and sustainability of the University with the aim to repurpose existing space where possible.

Following the development of the University’s Sustainability Sub-Strategy, consideration is being given to how the University can make a just and equitable transition to net zero carbon emissions and to reducing its impact on the environment. The revised Capital Investment Plan incorporates significant investment for sustainability-led projects, to deliver our Sustainability Sub-Strategy, and with respect to our climate and ecological imperatives.

The categories of project identified for potential investment within the capital plan are as follows:

- Research infrastructure

- Supporting growth

- Student experience

- New ways of working and learning

- Digital resilience

- Essential infrastructure and compliance

- Climate emergency

- Revenue generation/invest to save.

| |

2020-21

£000

|

2021-22

£000

|

2022-23

£000 |

| Total investment |

£14,426 |

£14,113 |

£23,016 |

Major Projects in 2022-23 included:

- Smart Working at Essex (SWAE) Phase 1 – This £7.9m project is almost complete and we have moved into Phase 2 (£1.3m). Phase 1 included the re-configuration of the University’s estate at both Colchester and Southend to enable growth and to improve the digital infrastructure to facilitate flexible and innovative working both on campus and remotely. Phase 2 continues the roll out across the University of the digital infrastructure.

- Investment in Sports Facilities of £408k including replacement synthetic sports pitch, new performance analysis and coaching room for University teams, upgraded lighting in the sports arena and refurbishment of the Time Out space.

- Research – Expenditure on Research Equipment in 2022-23 totalled £3.6m. Some of this expenditure was externally funded. Within this amount £1.1m expenditure was incurred on the Smart Technology and Experimental Plant Suite (STEPS) which will provide state of the art growth facilities for our fundamental and applied plant-based research.

- Parkside Phase 3a – The Parkside Phase 3a building is nearing completion with handover expected in November 2023. Work has now started to fit out the ground floor which will house the Institute of Public Health and Wellbeing (IPHW) and Health and Wellbeing Care Hub (HWCH) to support our ambitions to develop specialist research, workforce development and clinical facilities/services. The remaining floors will be commercially let and represent an extension of the Parkside Office Village on the Knowledge Gateway site.

Sport at Essex

As a campus-based university, sport plays an absolutely vital role in offering the best possible student experience, and creating the living and learning community that is central to the transformational education offered at Essex. During the past year we have pioneered some sector leading initiatives to enhance the student experience, and to benefit our local communities.

Fan Experience Project

Utilising the asset of the £12m Essex Sport Arena, opened in 2018, we have delivered a programme of weekly spectator sport events on campus that have attracted crowds of students, staff and the local community. Over the competitive sport season, a total of over 13,000 spectators watched our student sport teams in BUCS matches, and our Essex Rebels basketball and volleyball teams in national competitions. This was capped off by a British record-breaking audience for a Women’s British Basketball League, when 1,505 spectators saw our Essex Rebels team claim victory on our International Women’s Day special. The quality of the entertainment on offer was recognised by Basketball England who awarded us their national ‘gameday entertainment’ award.

We also created a first of its kind in the U.K., student supporters’ section, called the ‘Tribe’, which attracted 800 student members in its first year. As part of creating a culture of attendance on campus, the Tribe offers an inclusive and accessible social environment on campus that provides a new social environment at match days, and other social occasions. This innovation was recognised by the Colleges and Universities Business Officers (CUBO) who awarded us their national award for ‘innovation in student experience’.

Essex Rebels Community Programmes

Our men’s and women’s basketball and volleyball teams play in the national elite leagues under the name ‘Essex Rebels’. Alongside attracting large crowds to watch the teams at the Essex Sport Arena, we have also used this programme to benefit our local communities.

The Essex Rebels junior basketball programme has grown rapidly from inception in 2018, and now has over 300 children playing weekly in national league teams, after school clubs and children’s drop-in sessions. Alongside that over 2,000 children have attended the ‘Rebels Roadshow’ where sports scholarship students attend local schools, deliver assemblies and P.E. sessions, and act as inspirational role models for local children to pursue their own dreams in sport and education. Our sports scholarship students also work on a collaboration with Essex Police called ‘ballin’ with a bobby’, delivering basketball sessions in local parks and providing a medium for local youth and children to meet and talk with police officers.

F.A. Women’s High Performance Football Centre

In the past year we were selected by the Football Association to be the regional centre for the development of women’s football. This initiative focusses on developing the future workforce of coaches and support staff who will inspire the next generation of Lionesses, and working closely with the School of Sport, Rehabilitation and Exercise Sciences, this will place Essex graduates at the forefront of women’s football in England.

Debt, liabilities and liquidity

Despite the need to secure higher returns to counter the impact of inflation, cash continues to be managed prudently and losses due to the fixed interest investments have, very largely, been avoided. Cash, cash equivalents and short-term investments decreased to £101.8m (2021-22: £111.7m) over the year. The University Council set a requirement for a minimum of 60 days liquidity, and we achieved 169 days of general expenditure (excluding depreciation) at 31st July 2023, compared with 2021-22’s figure of 178 days. Total long-term debt outstanding at 31 July 2023 was £140.6m (2021-22 £142.8m). The University was fully compliant with its banking covenants and is on track to remain so in the foreseeable future.

2022-23 Performance Updates

Many positive performance outcomes have been achieved across 2022-23.

Guardian University Guide 2024

- Essex moved up 12 places to rank 30th in the Guardian University Guide 2024, our highest ever rank in this table. In doing so this represented a 55 place rank improvement over the last three publications. Essex ranked 4th nationally in The Guardian’s value added metric – a metric that indicates the extent to which a student exceeded expectations, based on entry qualifications.

Complete University Guide 2024

- Essex moved up seven places to 32nd in the Complete University Guide 2024 – ranking 3rd nationally for facilities spend and 10th for academic services. We are also 30th for research intensity.

National Student Survey (NSS) 2023

- Our performance in the National Student Survey showed great improvement this year, with the University ranking 28th for Overall Positivity of English Broad Discipline institution (100 institutions). Further, rank performance improved on all but one of the sections of the NSS, and found Essex sits above the benchmark performance in six of the questions (with nineteen in line with benchmark).

- The Times Good University Guide did not use NSS 2023, because of its late publication. We have created a proxy measure, had they used the 2023 data, to illustrate how this might have performed. This proxy found an expected rank improvement of about +35 places, to 44th, on the actual result last year.

Graduate Outcomes

- This year’s Graduate Outcomes survey (surveying 2020-21 graduates) found 92% of our biggest population – undergraduate, UK, full time students – were in some level of employment or further study 15 months after graduation, ranking us joint 4th of English Broad Discipline institutions.

- The majority of departments showed year on year improvement in the proportion of their students (same population as above) in professional level employment and/or further study (eleven of seventeen departments).

Student-Staff Ratio

- The Student Staff Ratio at Essex has seen year on year improvement and in doing so meeting our target ratios. The ratio improved from 16.0 to 14.6 over the past two years and is expected to be 14.3 this year. As such Essex improved +21 places in the Complete University Guide and Times Good University Guide, and +20 places in the Guardian university Guide on this metric.

Knowledge Exchange Framework (KEF)

- The third iteration of the KEF saw Essex rank 14th in the sector overall (previously joint 12th), 3rd in Cluster X (previously joint 3rd), and achieved our target of being in the top 50% for all perspectives.

- Essex has achieved high or very high engagement in 5 of the 7 KEF perspectives, and met or exceeded the Cluster X average for 6 of the 7 perspectives.

- Essex ranked 4th in the sector for the “working with the public and third sector” perspective.

- Essex continues to be ranked in the top 15 best performing institutions in the Sector for KEF 3

Times Higher Education World University Rankings 2024

- Essex remains ranked in the 301-350 bracket in this year’s THE World University Rankings publication, having ranked there in the last four publications. Of UK institutions ranked in this table, Essex moved up 3 places to 36th.

- Within this table, Essex have now moved up to =15th in the world for ‘International Outlook’, which examines the proportion of international staff, students and international co-authorship on research publications. Essex also now ranks inside the top 300 for the THE World University Rankings' newly titled ‘Research Quality’ (replacing ‘Citations’) measure having seen a 174 place rise this year.

Teaching Excellence Framework (TEF) 2023

- We have been awarded overall TEF Silver in this year’s TEF cycle, as well as Silver awards in both of the new elements: student experience and student outcomes. Silver indicates that “the student experience and outcomes are typically very high quality, and there may be some outstanding features”.

- Within the TEF datasets provided there were numerous examples of areas where performance hugely exceeded the benchmark performance across several subjects and characteristics splits, but there are some subject areas where performance fell below the benchmark and this issue of consistency continues to be a key area to address.

- As this TEF cycle assessed the period 2018-2022, we now have an extra year of data to assess at an early stage the performance that will underpin the next TEF submission in 2027. This early insight shows the latest data, which will constitute the first year of the next cycle, sits above benchmark on each of the Continuation, Completion and Progression (Graduate outcomes) measures. Further, our improved performance in the NSS, evidenced by not sitting beneath the benchmark on any section, sets us up well for the next TEF cycle.

Times Higher Education Impact Rankings 2023

- Essex rose in to the top 60 in the Times Higher Education (THE) World Impact Rankings this year, climbing 20 places to rank 56th out of 1,591 institutions across the world in the prestigious THE Impact Rankings, which recognise universities for making a difference to society and working towards a more sustainable future.

- This measures universities against the Sustainable Development Goals and this year Essex was ranked in the top 100 globally for nine of these 17 goals. The highlights were being ranked 17th for Peace, Justice and Strong Institutions, 18th for Reduced Inequalities, 27th for Responsible Consumption and Production, 28th for Gender Equality, 31st for Life Below Water, and 45th for Climate Action.

We are delighted to report that in our second submission to the THE Impact Rankings, the University of Essex achieved a world ranking of 56th out of 1,591 participating universities. This marks an increase of 30 places compared to the previous year which is a pleasing reflection of our commitment and continual efforts towards improving sustainable development.

Of the seventeen United Nations Sustainable Development Goals (SDGs), the University of Essex was ranked 17th in the World for SDG 16 Peace, Justice and Strong Institutions, 18th for SDG 10 Reduced Inequalities, 27th for SDG 12 Responsible Consumption and Production, and 28th for SDG 5 Gender Equality. In addition, we were ranked in the top 100 globally for a further five SDG’s including SDG 1 No Poverty (58th), SDG13 Climate Action (45th), SDG 14 Life Below Water (31st), SDG 15 Life on Land (79th), and SDG 17 Partnership for the Goals (45th).

Our strong performance in the Impact Rankings demonstrate how our efforts to operate in more sustainable ways are helping us to evolve as a university fit for the future. The result also reflects the world-leading contributions that our academic community continues to make through education and research in topics that have the greatest relevance and importance to the future of science, society, and humanity.

In 2020, the University of Essex declared a climate and ecological emergency accompanied by a detailed action plan, setting out the practical steps we are taking towards becoming carbon net zero by 2035. We take our promise very seriously and are continually acting and making new investments to ensure that not only are we improving the carbon footprint of our campuses but are also developing innovative education and research practices that are sustainable without compromising on excellence.

In our third Sustainable Development Report, which we have recently published, we are delighted to provide a more detailed update of our performance in relation to each of the SDG’s which also incorporates the full results of our 2023 Times Higher Education Impact Rankings. We are also happy to present a selection of examples of activities we have carried out in the last year that have made a positive contribution to each SDG.

Measuring the contribution of the University in progressing each of the Sustainable Development Goals is not easy. This is because during the past decade The University of Essex publishes on average 1,900 research outputs per year and we have approximately 3,000 different programmes of study including undergraduate, postgraduate and research degrees. That’s a lot of reading and it would be impossible to directly map every goal against each research paper and degree course. Instead, we have adopted keyword methodologies commonly used across the higher education sector, including the THE Impact Ranking which we have submitted to for the first time this year.

There are two commonly used keyword sets for each of the Sustainable development goals. The first set was developed by the Asia/Pacific Sustainable Development Solutions Network (SDSN) which is very broad and the other is the Elsevier keyword set which is used by the Times Higher Education and is much narrower. For our research we have used both keyword sets to search our publications using the Scopus indexing service, reporting the number of publications and citations Essex has achieved for each goal from 2012 to 2023. For our education we have indicated how many programmes relate to each SDG and how many student interactions there have been across these programmes since 2012.

1 http://ap-unsdsn.org/regional-initiatives/universities-sdgs/

2 https://service.elsevier.com/app/answers/detail/a_id/31662/supporthub/scopuscontent/

Table 1: Research Publications and Citations Associated with each Sustainable Development Goal

| |

Publications

|

Citations

|

|

SGSN

|

Elsevier

|

SGSN

|

Elsevier

|

|

SDG 1: No Poverty

|

3527

|

54

|

63484

|

494

|

|

SDG 2: Zero Hunger

|

2585

|

88

|

62099

|

2486

|

|

SDG 3: Good Health and Well-being

|

2384

|

1702

|

45929

|

36863

|

|

SDG 4: Quality Education

|

1502

|

32

|

22786

|

464

|

|

SDG 5: Gender Equality

|

1858

|

131

|

26770

|

1349

|

|

SDG 6: Clean Water and Sanitation

|

985

|

23

|

21399

|

321

|

|

SDG 7: Affordable and Clean Energy

|

1509

|

281

|

32266

|

6087

|

|

SDG 8: Decent Work and Economic Growth

|

4027

|

252

|

61844

|

4899

|

|

SDG 9: Industry, Innovation and Infrastructure

|

4963

|

65

|

87931

|

3185

|

|

SDG 10: Reduced Inequality

|

4955

|

281

|

77462

|

4480

|

|

SDG 11: Sustainable Cities and Communities

|

2961

|

124

|

61639

|

1898

|

|

SDG 12: Responsible Consumption and Production

|

2766

|

126

|

56870

|

2433

|

|

SDG 13: Climate Action

|

972

|

249

|

24296

|

6356

|

|

SDG 14: Life Below Water

|

543

|

179

|

16314

|

4908

|

|

SDG 15: Life On Land

|

1478

|

79

|

37842

|

3124

|

|

SDG 16: Peace and Justice Strong Institutions

|

2861

|

748

|

38908

|

8720

|

|

SDG 17: Partnerships to achieve the SDG

|

233

|

N/A

|

4511

|

N/A

|

Table 2: Degrees Associated with each Sustainable Development Goal and Student Engagements

| |

Relevant Degrees

|

Student Engagements

|

|

SGSN

|

Elsevier

|

SGSN

|

Elsevier

|

|

SDG 1: No Poverty

|

880

|

141

|

13746

|

1090

|

|

SDG 2: Zero Hunger

|

673

|

9522

|

9522

|

56

|

|

SDG 3: Good Health and Well-being

|

537

|

336

|

7366

|

4432

|

|

SDG 4: Quality Education

|

621

|

26

|

6731

|

167

|

|

SDG 5: Gender Equality

|

584

|

164

|

7803

|

985

|

|

SDG 6: Clean Water and Sanitation

|

232

|

2

|

1577

|

21

|

|

SDG 7: Affordable and Clean Energy

|

255

|

14

|

1886

|

152

|

|

SDG 8: Decent Work and Economic Growth

|

993

|

157

|

17106

|

1185

|

|

SDG 9: Industry, Innovation and Infrastructure

|

1219

|

15

|

16438

|

30

|

|

SDG 10: Reduced Inequality

|

1060

|

193

|

17821

|

1308

|

|

SDG 11: Sustainable Cities and Communities

|

626

|

27

|

7943

|

156

|

|

SDG 12: Responsible Consumption and Production

|

545

|

101

|

6794

|

1373

|

|

SDG 13: Climate Action

|

208

|

152

|

1596

|

994

|

|

SDG 14: Life Below Water

|

195

|

61

|

1996

|

297

|

|

SDG 15: Life On Land

|

293

|

22

|

222

|

169

|

|

SDG 16: Peace and Justice Strong Institutions

|

629

|

350

|

9469

|

3724

|

|

SDG 17: Partnerships to achieve the SDG

|

N/A

|

N/A

|

N/A

|

N/A

|

Future outlook and prospects

Despite the reduction in the number of 18-year-olds choosing to go to university, nationally, we remain optimistic about our plans to grow our University community to 1,000 researchers and circa. 20,000 students by the next Research Excellence Framework exercise expected in 2028. We are leaving no stone unturned, working closely with existing and new partners and through our regional international offices and schools' network to ensure that as many students as possible benefit from a transformative education with us.

Our ability to generate sufficient cash surpluses each year is key to delivering our mission and the scale of our ambitions. As a result of our declaration of a climate and ecological emergency, our focus on refurbishing existing buildings to ensure they serve the needs of our time – including new and more flexible ways of working rather than new builds – and a focus on developing our academic and professional services staff, mark an important and exciting evolution in our investment strategy.

Risk

Policy and approach

The University maintains a risk management policy, which forms part of the University’s internal control and corporate governance arrangements. The policy explains the University’s underlying approach to risk management and documents the roles and responsibilities of the University Council, the University Steering Group (USG) and other key parties. It also outlines key aspects of the risk management process and identifies the main reporting procedures. In addition, it describes the process the University Council follows to evaluate the effectiveness of the institution’s internal control procedures.

The following principles underlie the University’s approach to risk management and internal control:

- Council has responsibility for overseeing risk management within the institution as a whole.

- The Vice-Chancellor and University Steering Group (the University’s Executive) advise the Council and implements the policies it approves.

- The Audit and Risk Management Committee (ARMC) provides Council with independent assurance about the effectiveness of the University’s risk management arrangements.

- External Audit has an overview of the policy, making comments and recommendations of practical benefit.

- Internal Audit provides ARMC and Council with independent assurance about the effectiveness of the University’s risk management arrangements.

- The institution makes prudent recognition and disclosure of the financial and non-financial implications of risks.

- Heads of Departments and Heads of Section are responsible for developing awareness of risks within their units, and for identifying risks inherent in new developments.

- Key risk indicators are identified and monitored regularly.

Risk Appetite

The University recognises that risk appetite varies according to the activity undertaken and has developed a matrix determining the level of willingness to accept risks in pursuit of its strategic objectives. The approach is to minimise exposure to risks in the areas that relate to Health and Safety, regulatory compliance and the University’s duty of care to staff and students, whilst accepting and encouraging the active management of risk in order to pursue strategic priorities as defined in the University Strategy 2019-28. The matrix maps the University’s risk appetite against key strategic aims and compares the potential impact if things were to go wrong against the benefits if opportunities are realised; progress in realising those benefits is measured using a set of Key Performance Indicators, providing a measurable value that demonstrates how effectively the University is achieving key business objectives.

Risk ownership and management

The Registrar and Secretary, as the Risk Management Process Owner, is responsible to the Vice-Chancellor and USG for ensuring the operational effectiveness of the University’s risk management procedures. The Risk Management Group (RMG), chaired by the Director of Finance, Planning and Data Insight, provides guidelines on the assessment of risk in planning and decision-making and monitors compliance. The Director of Finance, Planning and Data Insight ensures that the Strategic Risk Register (SRR) is properly maintained, that the relevant preventive and recovery measures are implemented, and that a sufficiently comprehensive set of risk management plans are maintained.

For control of operational level areas, Faculties, Departments and Professional Services sections maintain local operational risk registers that identify risks and relevant mitigating actions. Local risk management groups conduct operational risk register reviews at least once a year and material changes (the addition of new risks, the removal of risks and significant changes to risk ratings) are reported to RMG on a cyclical basis.

This provides a clear route for risk identification and escalation. Risk owners are also required to report on the potential impact of risks on the Strategic Risk Register as well as any associated resource, legal, regulatory or equality implications, which require consideration by the University. Operational risk register updates enable RMG to understand local issues and to check consistency in scoring across broad risk themes; these, along with the strategic insight of RMG members and their knowledge of changes in the internal and external environment, allow RMG to assess the Strategic Risk Register critically on a termly basis.

Major movements in the risk environment and the University’s risk profile are then drawn to the attention of USG and ARMC by way of termly reports. This allows members of the executive team and external committee members to bring to bear their different perspectives, knowledge and experiences when scrutinising and contributing to the development of the Strategic Risk Register, ensuring that key areas of risk are not overlooked.

USG provides information to Council and to ARMC on a regular basis and will report on major risks and associated ameliorative measures. Council, which is responsible for reviewing the effectiveness of the internal control and risk management framework of the institution, will, on the basis of the information provided by the annual report of the Audit and Risk Management Committee; by the annual report provided by Internal Audit and by any other information provided by University Steering Group, form a view on the effectiveness of the risk management framework. It provides guidance to USG on ways in which procedures may need to be improved. The Risk Management Policy is reviewed annually by the Risk Management Group, ensuring that the policy is updated periodically to ensure that it remains fit-for-purpose and in line with best practice.

Key risks

The University’s vision for 2028 is to be recognised nationally (top 30 Times Good University Guide) and Globally (top 200 Times Higher Education World University Rankings) for the quality and impact of our transformational education and for the international excellence and world-leading quality, scale and impact of our research. The risk of the University not meeting its targets for overall performance and national and international ranking and academic standing has been evaluated as the highest rated strategic risk.

Essex saw improvements in SSR (+21 places), UCAS entry points (+9 places), and Good Degrees (+7 paces) in the latest publication of the Times Good University Guide. These changes, along with an improved Student Satisfaction performance in the NSS 2023, were expected to result in a substantial improvement in overall rank. However, due to changes in the composition of the league table this year, this resulted in a –2 rank fall. When modelling to account for these changes not having been carried out, we would have expected an overall rank in the top 30. This gives us confidence that the actions the institution is undertaking puts us on a positive trajectory that we are in a position to meet our targets in this area.

We aspire to offer transformational education to about 20,000 students, to achieve transformational research through a community of about 1,000 researchers and to extend the knowledge base by investing in new disciplines that meet the needs of our time and to ensure the financial sustainability of the University. A reduction in the size of our undergraduate Home/EU population has presented a risk to us achieving these aims but we have been agile in our response through the development of growth and sustainability plans; this has resulted in new product delivery and international and postgraduate student growth to mitigate what we anticipate being a short-term reduction in the Home/EU market. This has put the University in a strong position to be confident of meeting its growth targets by the end of the strategic planning period.

The growth and changing shape of our student population does however present an ongoing challenge when it comes to providing adequate facilities that align with our ambitious growth and sustainability plans. Our Estates team is actively engaged in adapting our facilities to meet these evolving needs, adopting a proactive approach to physical infrastructure works with the ability to forward plan.

The risk of cyber-attacks is a sustained threat to our digital estate, but the University has embedded a range of cyber security controls and processes which measure defence maturity against industry best practice frameworks to ensure we are best placed to respond when required.

The University recognises that the ability to recruit, develop and retain high quality staff is critical to achieving its strategic objectives. The staff recruitment market was particularly challenging during and in the immediate aftermath of the pandemic as the dust was settling on new hybrid working practices. The University however put in place additional measures to bolster recruitment opportunities through an onboarding and recruitment process review, and recent recruitment success across the board has meant that the associated strategic risk has been placed on positive watch.

Key Performance Indicators

Progress against key performance indicators, set in accordance with the University Strategy 2019-2028, is summarised in the table below. Further below is a commentary on those indicators where we are performing well, improving or continuing to work hard to see the performance to which we aim.

| |

Completion of 2022-23 Target

|

Latest Data |

Performance at completion of 2022-23

|

Performance at completion of 2021-22

|

|

Rank

|

Value

|

Rank

|

Value

|

|

1 - TGUG Rank1

|

30th

|

TGUG 2024

|

56th

|

594

|

54th

|

598

|

|

Guardian University Guide

|

-

|

GUG 2024

|

30th

|

63.5

|

42nd

|

70.8

|

|

Complete University Guide

|

-

|

CUG 2024

|

32nd

|

712

|

39th

|

674

|

|

Daily Mail University Guide

|

-

|

DMUG 2024

|

41st

|

722

|

N/A

|

N/A

|

|

2 - THE-WUR Rank

|

250th

|

THE-WUR 2024

|

326th

|

52.0

|

308th

|

48.5

|

|

3 - TEF

|

Gold

|

TEF 2023

|

Silver

|

Silver

|

Gold

|

Gold

|

|

4 - Student Satisfaction2

|

25th

|

NSS 2023

|

44th

|

81.3%

|

79th

|

73.0%

|

|

5 - Graduate Outcomes

|

25th

|

TGUG 2024

|

77th

|

75.2%

|

68th

|

72.6%

|

|

6 - Student Outcomes (E&D)

a. Progressions3

|

<10%

|

2022-23 Entrants

|

-

|

35.5%

|

-

|

53.2%

|

|

6 - Student Outcomes (E&D)

b. Good Degrees3

|

<10%

|

2022-23 Leavers

|

-

|

27.6%

|

-

|

22.8%

|

|

6 - Student Outcomes (E&D)

c. Graduate Outcomes3

|

<10%

|

2021-22 Leavers

|

-

|

3.3%

|

-

|

7.6%

|

|

7 - Research Degree

a. Completion

|

70%

|

2022-23

|

-

|

93%

|

-

|

90%

|

|

7 - Research Degree

b. Awards

|

0.22

|

2021-22

|

-

|

0.20

|

6th

|

0.22

|

|

8 - Research Quality

|

20th

|

TGUG 2024

|

41st

|

50

|

41st

|

50

|

|

9 - Citation Rates

|

40th

|

2018-22

|

81st

|

10.2

|

80th

|

9.1

|

|

10 - Research Income

a. Income/Staff FTE4

|

20th

|

2021-22

|

43rd

|

£48,649

|

46th

|

£52,039

|

|

10 - Research Income

b. Income from Industry

|

£9.7m

|

2021-22

|

14th

|

£4,539,000

|

16th

|

£4,181,000

|

|

10 - Research Income

c. HE-BCI Income

|

£33.4m

|

2021-22

|

12th

|

£28,460,000

|

12th

|

£25,685,000

|

|

11 - Financial Sustainability

a. Cash Surplus/Deficit

|

5.5%

|

2022-23

|

-

|

5.8%

|

-

|

4.9%

|

|

11 - Financial Sustainability

b. Institutional Liquidity Days

|

60

|

2022-23

|

-

|

169

|

-

|

180

|

|

11 - Financial Sustainability

c. Institutional Borrowing

|

>2

|

2022-23

|

-

|

3.6

|

-

|

3.5

|

1 KPI-01: Council approved the change to the KPI-01 target (top 25) to Top 30 by 2028 – approved Spring 2023

2 KPI-04: Essex would normally use what was published in the TGUG to populate this KPI. However, this year the TGUG did not update their Student Satisfaction measure and therefore we do not have a new indicator. Therefore, instead, we have produced latest performance from the 2023 iteration of the NSS, using a TGUG-based proxy measure to illustrate what our performance would have been had they used this latest data.

3 KPI-06a,b,c: Council approved a change to how we view progress, assessing proportion of flags rather than absolute numbers which can change due to population size rather than changes in performance – approved Spring 2023. As a result of that previous year’s performance has been changed to reflect this also.

4 KPI-10a: Council approved a change to the methodology of calculation comparing research income of the current year against the staff FTE of two years prior – approved Spring 2023. As a result of that previous year’s performance has been changed to reflect this also.

Consistently performing well

- KPI-06c – Student Outcomes (E&D) Graduate Outcomes. This KPI measures the extent of gaps for students achieving high level employment/further study in six protected characteristics. The proportion of gaps across our departments, across five characteristic groups of students has fallen to just 3.3% (representing just two instances of performance gaps out of 60 combinations). This is the third year in a row of improved performance and all year subsequent years perform better than the baseline year.

- KPI-07a – Research Degree Completion. This is, and has remained throughout, well above the target set, having grown once again this year (to 93% completion), the fourth year of sustained improvement.

- KPI-10b – Industry Income. This year we recorded our highest ever income from industry figure showing consistent years of strong growth either side of the pandemic, and an immediate bounce back from the disruption caused by the pandemic. This latest income is 175% of the 2019 baseline figure.

- KPI-11a, -11b, -11c – Financial Sustainability. These all remain green exceeding targets based on provisional final figures (awaiting outcome of audits).

Steady improvement

- KPI-01 – TGUG Rank: fell by 2 rank positions this year. However, the fall here is in spite of improvement in many of the component metrics, but because of the choices made by the table compilers, these improvements are not reflected. Had they been included, Essex would have ranked in the region of 27th and thus would be exceeding the KPI target.

- Last year, the Services/Facilities Spend metric was removed from the TGUG league table and this remains removed. This was a metric for which Essex would have ranked first in the sector in each of the last two years and we predicted would have resulted in an approximate +15 place rank improvement overall. This year, due to the later publication of the National Student Survey (NSS) 2023 results the TGUG took the decision to not only not use the latest data and instead use NSS 2022 results, but also to maintain the same method as that used last year. Had they used the NSS 2023 results, we anticipated a rise of approximately +10 places. Last year the TGUG took the decision to change the Tariff metric to account for pre-pandemic entry levels, they have kept this methodology again. This uses 2019-20 entrants double weighted and then combined with 2021-22 entrants. Essex has done considerable work on the data and the entry level of our students to greatly increase our tariff levels since 2019. Had they used the 2021-22 entrant’s dataset only, we anticipated a rise of approximately +2 places.

- With these three choices made by the TGUG compliers, we estimate this has resulted in a rank difference for Essex of approximately 29 places, whereby we would have expected a ranking in the region of 27th rather than a ranking now

of 56th.

- We use the TGUG as a way of benchmarking and monitoring our performance, but there are three other domestic league tables (the Guardian University Guide, Complete University Guide, the and the new Daily Mail University Guide) that we also monitor and use for marketing purposes. The Guardian University Guide (GUG) saw Essex rise into the top 30 for the first time in this guide, a rise of 12 places on last year and a 55 place rise over the past three publications. This included Essex ranking 4th nationally in The Guardian’s value added metric – a metric that indicates the extent to which a student exceeded expectations, based on entry qualifications. In the Complete University Guide (CUG) Essex moved up seven places to 32nd in this year’s iteration. This included ranking 3rd nationally for facilities spend and 10th for academic services. We are also 30th for research intensity. In the very first iteration of the Daily Mail University Guide (DMUG) Essex entered at 41st.

- KPI-04 – Student Satisfaction. As noted above, due to the later publication of the NSS 2023 results the TGUG took the decision to not only not use the latest data and instead use NSS 2022 results, but also to maintain the same method as that used last year. Therefore, to understand our current performance, we created a proxy measure, that uses TGUG methodology, had they used the 2023 data. This proxy found an expected rank improvement of about +35 places, to 44th, on the actual result last year. Given the NSS 2024 results are expected to revert to a traditional July release date, we would expect NSS 2024 to be used next year.

- KPI-10a – Research Income/staff FTE. Whilst this has fallen slightly this year, this was primarily driven by consistent increases in staff FTE. Because we use published data – in order to obtain a rank – there is a lag in reporting this, and we can already see our more recent year of data (2022-23) and can see that substantial improvement is on its way in this KPI, including our highest ever Research Income figure (£35.7m). We cannot report a rank figure for this yet as the sector data will not be available until early 2024, but as a score, we anticipate a large increase.

- KPI-10c – HE-BCI Income. This year we recorded a substantially improved income figure, our second highest ever, showing an immediate bounce back from the disruption caused by the pandemic.

- KPI-02 – THE-WUR Rank. Essex remains ranked in the 301-350 bracket in this year’s THE-WUR publication, having ranked there in the last four publications. Although they do not publish our specific rank, we are able to self-calculate this to a strong degree of confidence and find we now rank 326th (having ranked 308th last year). Of UK institutions ranked in this table, Essex moved up 3 places to 36th. Within this table, Essex has now moved up to =15th in the world for ‘International Outlook’, which examines the proportion of international staff, students and international co-authorship on research publications. Essex also now ranks inside the top 300 for the THE-WUR’s newly titled ‘Research Quality’ (replacing ‘Citations’) having seen a 174 place rise this year.

- KPI-08 – Research Quality. Now using REF 2021 this score and rank will remain static for the next five publications of the TGUG. A conscious decision was made to provide a REF submission that optimised the QR funding potential of the submission, which is not always compatible with improved performance in the TGUG metric. This was successful with recurrent research grant increasing by £4.5m a year. Good progress is being made with early substantial preparations for the next REF that will take place in 2027-28.

- KPI-09 – Citation Rates. Essex has seen consistent year on year growth in the citations per publication value, however the rank continues to fall against the UK sector. Encouragingly the size of our growth exceeds the growth of the sector and a similar metric used in the THE-WUR saw an improved score. Within the pillar of metrics this and other citations-related metrics are held, Essex saw a huge 174 rank rise, to now rank inside the top 300 for the citations-related pillar (called Research Quality).

- KPI-06a – Student Outcomes (E&D) (Progression). This KPI measures the extent of progression gaps in five protected characteristics for progression from stage 1 to stage 2. A red flag equates to a 10% progression gap between groups in within a protected characteristic e.g., Male and Female. Last year we saw an increase in gaps classified red, but this year this proportion has fallen, more importantly, this fall in gaps has fallen all the way down to no gaps at all (classified as green), with that proportion (47% of all flags) being our highest proportion of green flags (‘no gap’ flags) of the strategic plan period.

Work in progress

- KPI-03 – TEF. Essex has been awarded Silver in this year’s TEF, having been awarded TEF Gold in the previous iteration in 2017. New TEF datasets are released each year in the run up to the next cycle (expected TEF 2027, in 2026-27), and this latest data is scrutinised to ensure action plans are in place to improve performance across the metrics and splits of the data (subjects and characteristics) in preparation for the next TEF submission.

- KPI-05 – Graduate Outcomes. Having lost ground during the pandemic period, our performance on this metric improved in value – and is now the highest score we have achieved in the Graduate outcomes survey in the TGUG (this is the fourth iteration), however, this has not kept pace with the bounce back seen across the sector and thus saw our rank fall nine places. Robust plans are in place for Graduate prospects/outcomes to continue this upwards trajectory in score, hopefully seeing rank improvements subsequently.

- KPI-06b – Student Outcomes (E&D) Degree Classifications. This KPI measures the extent of attainment gaps in five protected characteristics for 2:1s and 1sts. A red flag equates to a 15% attainment gap between groups in within a protected characteristic e.g., Male and Female. This is an area which requires work as the proportion of red flags has risen year on year. The proportion of amber flags (small, but present gaps) has also grown, where it is the ’no gaps’ category that shrunk. Gaps seen previously in students from more deprived areas (IMD Q1+2) have lessened (eight gaps down to six), whereas gaps in ethnicity and age groups have increased this year (an additional three each).

- KPI-07b – Research Degree/Staff FTE. This year saw a small fall in value, with a large fall in rank (scores on this KPI are very closely packed). This decrease in KPI-07b is driven by an increase in staff numbers once again this year, coinciding with a small decrease in the number of awards awarded this year.

2022-23 Financial Statements